February 2018

Monthly Market Summary

February 2018

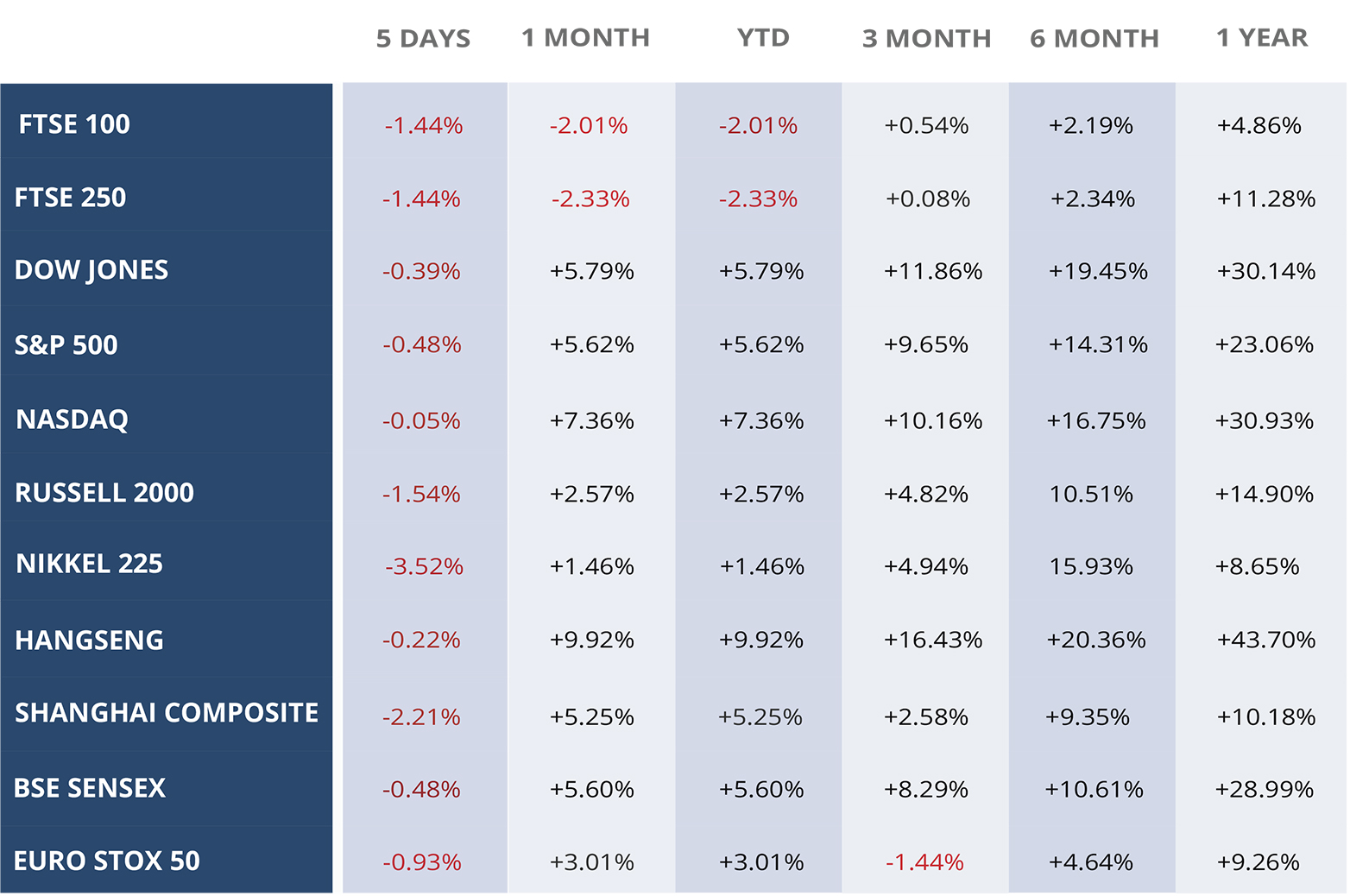

US Equities continued their upward momentum in January supported by a strong earnings data and the robust growth in retail sales in the US. The S&P grew by 5.6% in January; the strong earnings dampened the impact of lower than expected GDP growth rate for the last quarter of the year.

In the US Fixed Income domain, the recovery in the US and job growth has further strengthened the case of rising inflation, thereby increasing the bond yields and lowering the bond prices, the US 10 yr Treasury yield now sitting at 2.7%. Although the US core inflation stood at 1.8% (below the target of 2%), the Fed is confident of it reaching this target and therefore is determined to follow a tight monetary policy to prevent overheating in the economy.

UK equities remained under pressure as the investor confidence deteriorated over the concerns of BREXIT uncertainty restricting the UK in benefiting from the recent spur in Global economic growth. The gains in Sterling further added to the pressure on FTSE 100, as 70% of its companies generate revenues outside the UK. Investors remain optimistic about European equities with the consumer confidence and PMI at record high levels as per the surveys, the Eurozone seems to be into a robust recovery period. The pan – European benchmark STOXX 600 ended the month up 2.1%.

The Nikkei 225 posted a paltry +0.1% over the last month. The market had some initial upswings in the month. However, the monthly performance was dampened due to the pressure from a rising Yen against the Dollar at the end of January, and the concomitant Wall Street sell-off in the futures market.

China’s manufacturing sector PMI came out to be lower than expected in January amid a cooling property market and tighter pollution rules that have curtailed factory output. The Indian stock markets posted their best one-month pre-budget gain in 13 years, the performance was a result of growing optimism and the investor confidence in the government reviving investment and growth in the last full budget before next year’s general election.

US Dollar exchange rate had one of its significant declines in January, down 3.2% against the basket of major currencies. The widening current account deficit with the strengthening global growth outside the US had put downward pressure on the dollar. Comments from the US Treasury Secretary Steven Mnuchin highlighting the advantages of a cheap dollar exchange rate further added to the dollars misery.

Oil had an excellent start to the year with the Brent gaining 3.26% over January 2018. The move was a result of OPEC’s decision to cut output. The fall of the USD exchange rate also supported the higher prices.

WEEKLY EQUITY MARKET UPDATE – 31/01/2018

Leave a Reply

Want to join the discussion?Feel free to contribute!