EQUITIES & DOLLAR SUFFER FROM UNCERTAINTY IN US FISCAL POLICY

Latest Market Summary

EQUITIES & DOLLAR SUFFER FROM UNCERTAINTY IN US FISCAL POLICY

The week started with the ratcheting up of geopolitical tensions between Saudi Arabia and Iran, resulting in the sharp rise in oil prices. However, it was the US fiscal policy that garnered most of the attention in the markets after the Senate proposed their version of the draft tax bill, which differed noticeably from the House’s version. The expectations of the tax cut was one of the main reason for the rise in the dollar since the mid of September, as a result of the ambiguity in the tax bill the dollar index fell to 94.26 which is the lowest in two weeks before coming back to 94.42. The US equity benchmark was down by 0.4% this week ending the eight-week run of growth.

RISE IN DEMAND FOR GREEN BONDS

Skyrocketing demand has led to a record high issuance of Green bonds in the third quarter of the year. The issuance for the quarter ended in September stood at USD 32.7 billion which is a 1.55% increase over the USD 32.2 billion issued in the previous quarter. The issuance in the first three quarters of this year has been around USD 95 billion which is an increase of 49% year on year, based on the recent figures the full-year volume is set to surpass USD 120 billion for the first time in history.

ACTIVE US FUNDS FACING MAJOR CHALLENGE IN THE FORM OF FUND OUTLOWS

The past week has seen an outflow of USD 4.5 billion out of US funds despite the improved performance of traditional investment managers, taking the cumulative outflow this year over USD 150 billion. Moreover, the performance of the active managers have increased considerably in 2017, about 55% of the fund managers have beaten their benchmarks this year making 2017 the best year for yearly performance since 2007. Japanese equity funds continue to receive significant inflows since Shinzo Abe’s victory last month. European bond funds had a positive week too, making this their second-strongest inflows this year.

US SENATE TAX PLAN ZERO IN ON MULTINATIONALS

The Senate in its draft tax bill proposed a tax of 10% on income from intangible assets such as intellectual property, however it would be levied differently on US companies and American subsidiaries of foreign companies. The income from US intangibles is likely to be taxed at a favourable tax rate of less than the new 20% proposed corporate tax rate, in order to encourage American companies to move intellectual property back to the US. The Senate also proposed for the US subsidiaries of foreign companies a minimum tax to prevent them from using intra-company payments for intangibles to reduce their effective tax rate below 10%.

BEIJING SUPPORTS INCREASED FOREIGN OWNERSHIP IN FINANCIAL SERVICES

China which has traditionally utilized joint ventures requirements and ownership limits in its industries to protect Chinese companies is likely to relax or remove ownership limits in Financial Services. The limit on foreign stakes in life insurance joint ventures will be increased to 51% in 3 years and removed entirely in 5 years. This move comes a day after Trump called on China to allow greater access to American companies.

IN OTHER FINANCIAL NEWS :

- Pay growth in the UK is likely to improve in 2018,,as companies are increasingly facing recruitment difficulties, as per the latest report by Bank of England on Wednesday.

- Rising pessimism over the housing makers among the Estate agents,,as the prices have not seen any upward movement in the last three months. The optimism shown by surveyors and estate agents has fallen on multiple measures to its lowest level since Eurozone crisis.

- Gold Demand slumped to an eight-year low,,as the prospect of higher US interest rates and tighter monetary policy prompting less buying from institutional investors.

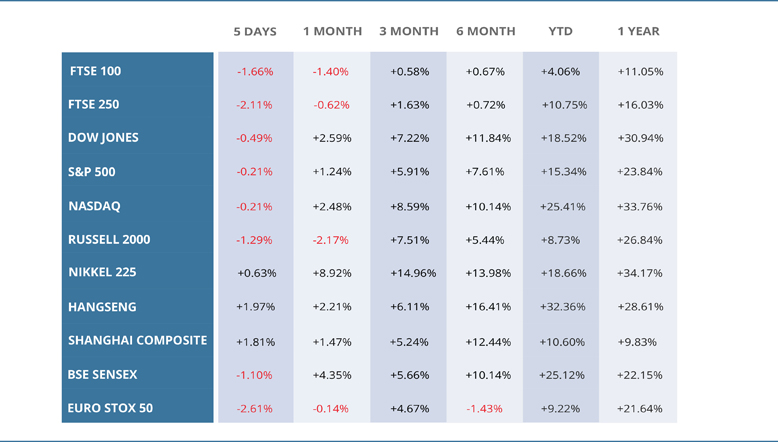

WEEKLY EQUITY MARKET UPDATE

Leave a Reply

Want to join the discussion?Feel free to contribute!