US STOCKS ACHIEVE NEW HEIGHTS

Latest Market Summary

US STOCKS ACHIEVE NEW HEIGHTS

The US equity indices and the dollar ended the week up as the investor sentiment strengthened over the likelihood of the passage of the tax overhaul before the end of this year. The Dow Jones rose by 143.08 or 0.6%, the S&P 500 was up by 23.80 points or 0.9% and the NASDAQ composite advanced by 80.06 points or 1.2%. The proposed tax cuts are likely to benefit the smaller companies and financial firms the most. The tax overhaul is to add to the already strong expectations about the economy and markets for the year 2018.

FTSE GAINS ON WEAKER POUND AS BREXIT NEGOTIATIONS REACH NEXT ROUND

The pound lost 0.9% against the strong dollar over concerns of a tougher second round of BREXIT negotiations between the UK and the EU. The FTSE 100 posted a gain of 0.6% on Friday as the weakness in the sterling favoured the index which comprises mostly of companies with global operations. The EU leaders confirmed their satisfaction over the first phase of BREXIT talks, however the officials have called on the Prime Minister to clarify what Britain wants from its future relationship with the block.

US GOVT BONDS END THE WEEK WITH A PRICE DROP

US Govt bond prices fell on Friday but stayed up over the week, supported by the weak inflation data. The yield on the 10-year Treasury note settled at 2.353% compared to 2.383% last Friday. Over the week, the uncertainty around the passage of the Tax overhaul, the soft inflation figures and the demand for Treasurys from overseas buyers kept the pressure on the yields even after the Fed raised short-term interests.

PROFIT BOOKING OF $2.1 BILLION FROM EUROPEAN EQUITY FUNDS

Equity funds owning shares of companies in developed economies in Europe have witnessed outflows of $ 2.1 billion in seven days to Wednesday, according to the EPFR. Investors cashed in on the returns made this year after assessing the potential risks Europe faces in the coming year. The fall in the amount of debt the ECB will purchase every month, and the prospect of an Italian general election were some of the major potential risks to Europe.

DOLLAR SCARCITY PROPELS FUNDING COSTS

The cost to derivatives that allows global investors access to US Dollars have gone up significantly. Such derivative contracts are used by non-US banks in their credit activities, any scarcity of dollars make it more expensive to borrow. New regulations introduced to make the financial system transparent and safer have made the dollar scarcer, the roll back of its monetary stimulus by Fed is likely to further add to this.

HAMMOND OPENS LONDON FOREX MARKETS TO CHINESE BANKS

In his two-day visit to Beijing, Chancellor Phillip Hammond will sign a deal letting the Chinese banks to trade renminbi in the London forex markets. The Initiative is another step for the Chinese in internationalizing their currency, for the UK it means new business to London financial markets. The Chinese will be granted access to the “spot” foreign exchange in London with trades guaranteed by Shanghai Clearing House.

IN OTHER FINANCIAL NEWS :

- The inflation in UK breached the target of 3.1%,a fall in the value of the pound has led to higher import prices which fed through to consumer prices

- FED signals three more rate hikes in 2018,The Federal Open Market Committee increased the target of federal funds rate by a quarter point to 1.2% – 1.5% even though inflation is has remained below its target.

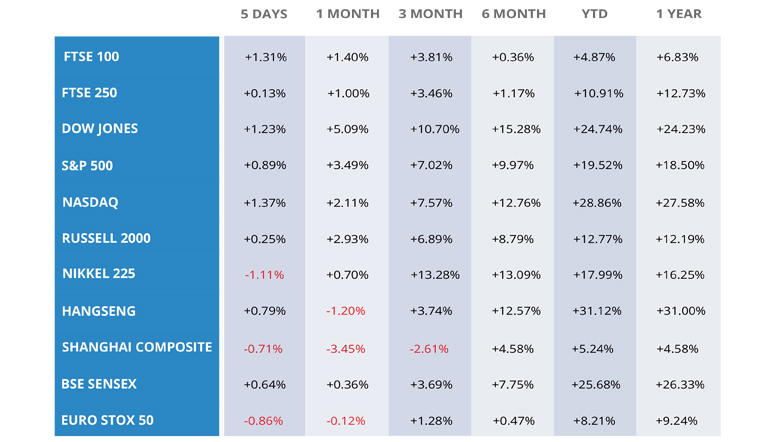

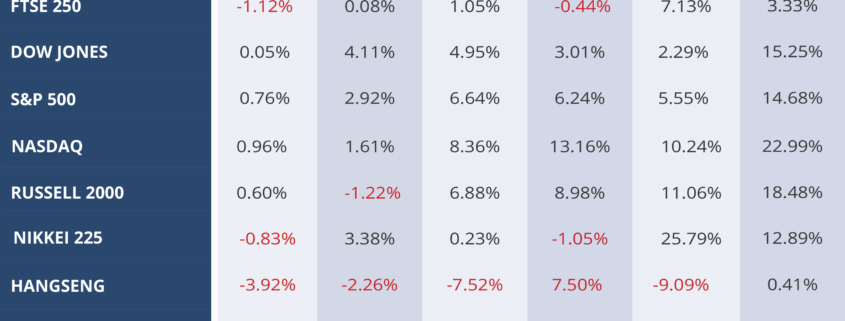

WEEKLY EQUITY MARKET UPDATE

Leave a Reply

Want to join the discussion?Feel free to contribute!