TECHNOLOGY STOCKS TAKE US INDICES TO RECORD HIGH

Latest Market Summary

TECHNOLOGY STOCKS TAKE US INDICES TO RECORD HIGH

After suffering two disappointing weeks, the US markets posted record high figures backed by the stellar performance of technology and energy stocks, while Amazon and retail stocks got the much-needed fillip from a spurt in consumer spending at the very outset of the holiday shopping season. The Dow Jones rose 31.81 points, or 0.14 percent, to 23,557.99, while the S&P gained 5.34 points, or 0.21 percent, to 2,602.42. The Nasdaq added 21.80 points, or 0.32 percent, to 6,889.16. The CBOE Volatility Index better known as the VIX and the most widely followed barometer of expected near-term stock market volatility, closed at 9.67, nearly a three-week low. The energy index and the materials index were boosted by rising commodities prices.

UK GILT PRICES STAGNANT AS WAIT FOR BREXIT CONTINUES

The benchmark 10-yr yield over the last week has remained stagnant and hovered around 1.25% despite an increase in the sale of government debt proposed in the budget. The debt players in the market struggled to find the correct level of UK bond prices amid uncertainty over BREXIT and the next month’s Bank of England policy meeting.

EUROPEAN BANK REDUCE EXPOSURE TO UK ASSETS

European banks have removed € 350bn of their UK based assets from their balance sheets in the last 12 months. The move comes in the wake of a possible scenario of a hasty BREXIT with no deal being finalised since the referendum 16 months ago. Bank assets decreased from € 1.94tn to € 1.59tn from June 2016 to June 2017, in the same period Bank liabilities dropped down from € 1.67tn to € 1.34tn.

S&P DOWNGRADES SOUTH AFRICA

The S&P downgraded the country’s local debt to “junk” status. The agency highlighted the growing concerns about the stagnation in the economy and believes that the fiscal measures likely to be proposed in the next budget will be insufficient to stabilise public finances. The downgrade was followed by a 2% fall in the local currency taking it to 14.14 per US Dollar.

LIBOR TO BE PHASED OUT IN 2021

The FCA with the support and agreement of 20 banks have agreed to replace LIBOR with a market-based alternative in 2021. The LIBOR has been used as a benchmark to value sterling based derivatives and other financial products. The decision to replace LIBOR was made after there were questions raised on its sustainability post BREXIT.

START-UPS TO BENEFIT FROM PENSION FUND INVESTMENTS

Pension funds will be allowed to take more risk and invest into start-ups which have hitherto been deemed as speculative. The proposed changes are part of a Government’s industrial strategy which endorses more private investment into start-ups and knowledge-intensive companies to improve skills, innovations and tackle UK’s productivity conundrum and shrinking economic growth.

DIVIDENDS RECORD FASTEST GROWTH IN 3 YEARS

Global dividends grew at the fastest rate in 3 years in the third quarter of 2017, backed by the above-expected economic growth figures, a sharp rise in UK payouts and a robust US market. The dividend growth rate rose by 14.5% to $ 328.1 bn in the three months to the end of September. Experts believe this was driven by an improvement in the global growth scenario which translated into strong corporate earnings.

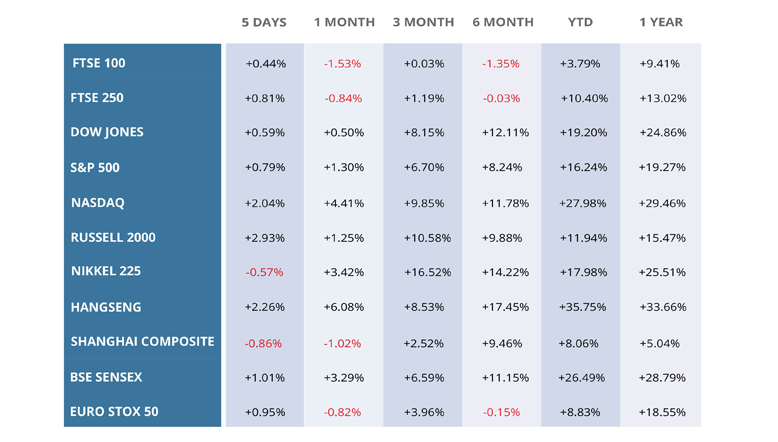

WEEKLY EQUITY MARKET UPDATE

Leave a Reply

Want to join the discussion?Feel free to contribute!