You no doubt have heard about the benefits of diversification, It’s not just “all talk”. Your portfolio must have some degree of diversification. After all, you don’t want to “put all your eggs in one basket”.

Investing all your money in one or a limited number of assets increases the risk of your portfolio. If something goes wrong with one of these assets, this could impact all your money. Rather than having all your eggs in one basket, you take some and put them in different baskets (asset classes). That’s diversification.

What is Diversification?

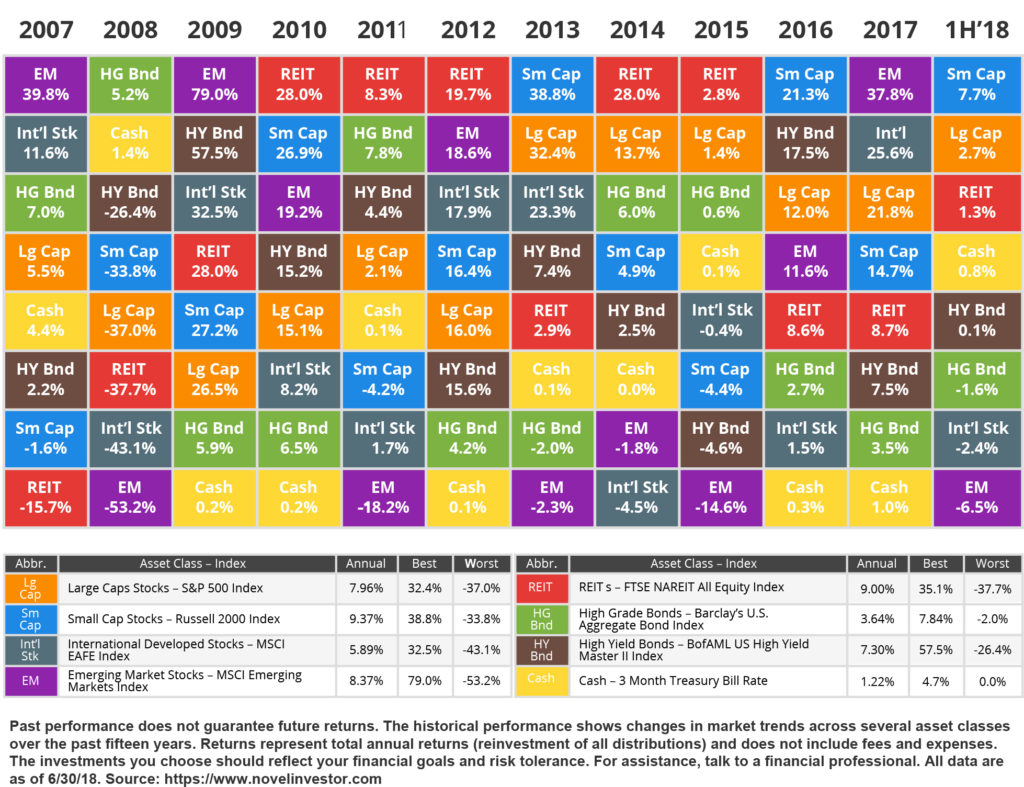

Diversification is the attempt to reduce exposure to risk by spreading your investment across carefully selected asset classes and geographical regions. You can achieve diversification by allocating, for instance, a certain percentage of your investment to fixed income, equities, real estate, alternative investments, in different sectors, industries or countries.

Although diversification is no guarantee against loss, it’s a prudent strategy you can adopt towards your long-term financial goals.

Why Diversification Work?

Many studies demonstrate the effectiveness of diversification. To put it simply, when you spread your investment across low correlation assets, you reduce the exposure to volatility. The reason for this is that different asset classes and geographical regions don’t move up and down simultaneously or at the same rate. So, if you mix things up in your portfolio, you’re less likely to experience major drops. Remember that some sectors might be thriving while others are going through tough times.

How to Diversify Your Portfolio?

Personal finance courses teach this concept widely in contrast to individual stocks investing. They consider single stock investing similar to casino gambling. In fact, many investors never even invest in individual stocks. Instead, they prefer mutual funds and exchange-traded funds (ETFs). These funds bundle hundreds of stock from various companies and sell them as a singular unit.

You can diversify your portfolio by selecting mutual funds and ETFs from different sectors that follow different trends. Some might follow the ups and downs of the broader market while others remain relatively flat. Other funds might move inversely to the broader market, experiencing ups when most sectors are down and vice versa. So no matter how the market is behaving, a portion of your portfolio is likely to do well. At the same time, this strategy protects against the full exposure of a correction.

Generally speaking, a well-balanced portfolio diversifies away the maximum amount of market risk. Owning additional asset classes takes away the potential of big gainers significantly impacting your bottom line. This is the case with large mutual funds investing in hundreds of stocks, in theory, putting your eggs in hundreds of different baskets.