Monthly Market Summary

May 2018

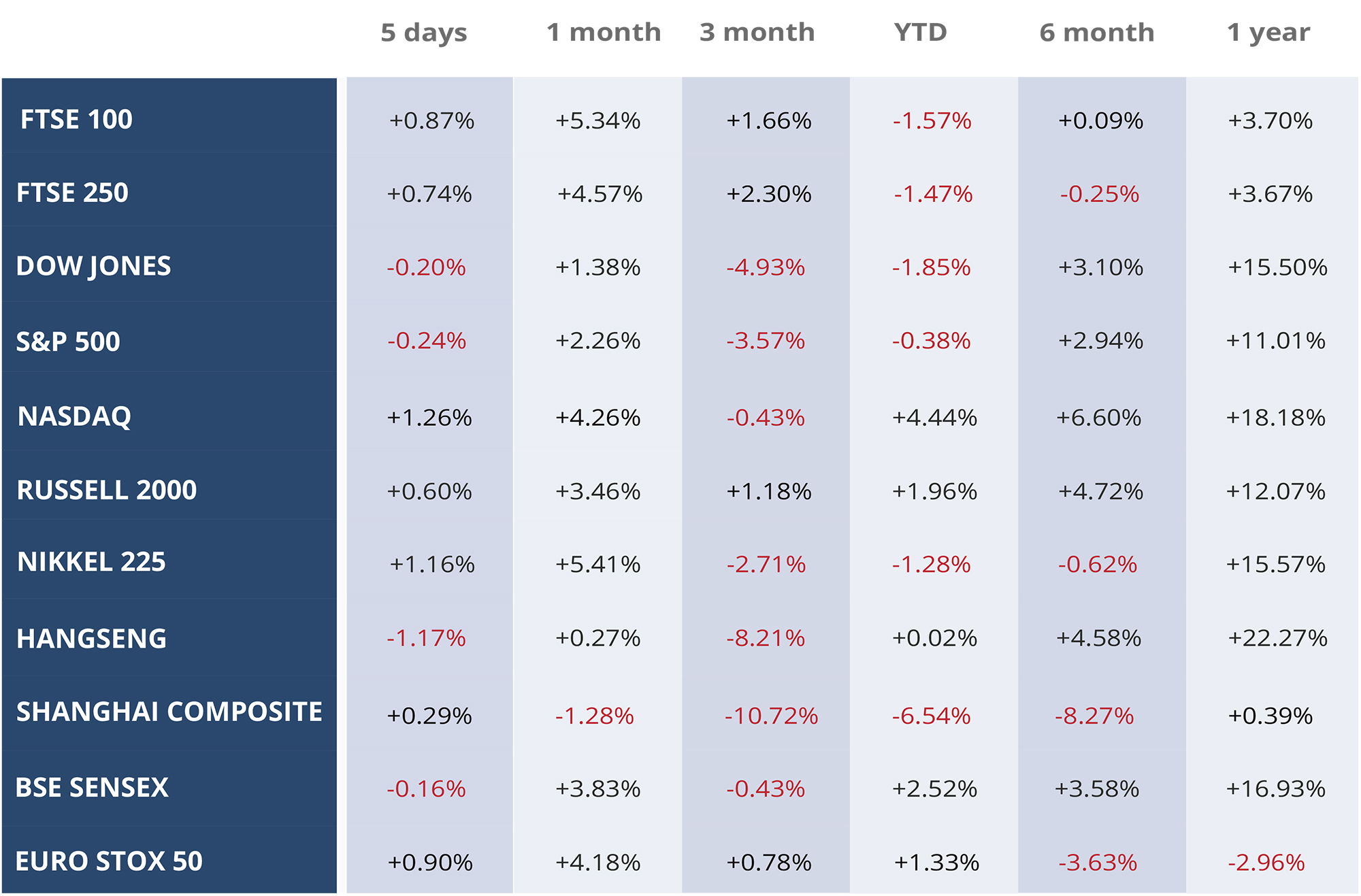

The Global Market participants expected a jittery start in the month of April over the mounting fears of a prolonged trade war between the two major economic powerhouses namely the US and China. However, later in the month, IMF published its global trade report which showed global trade is poised to hit an annual growth rate of 3.9% this year which will be the highest since 2011. Over the course of the month, the trade war fears eased and most of the major indices recovered the losses made in the early days of the month. Oil prices continued to climb as the Brent Crude breached the $ 72 per barrel mark over tensions in the Middle East arising from the threats from Israel and the US which may jeopardize the hard-earned nuclear deal with Iran Another major highlight from April was the detente between the two Koreas after the recent visit of the North Korean leader to South Korea, the meeting with his counterpart in South Korea and a promise of shutting down the nuclear program. This thaw in relations between the two nations has alleviated considerably one the major geopolitical risk the markets faced until now. The UK markets posted stellar gains for April. The BREXIT transitional deal eased some of the uncertainty in the markets, in addition to that the wage growth rate surpassed the inflation rate and the unemployment rate fell to 4.2% indicating a strong labour market. The FTSE 100 gained 6.42% (452 points) ending the month at 7,509.3, and the FTSE 250 was up 4.24% (824.58 points) over the same period. The weakness in GBP favoured the FTSE 100 over FTSE 250 as the former includes multinationals with revenue receipts in multiple currencies. Despite the easing of trade and geopolitical tensions, the US markets ended the month of April marginally up or flat. The S&P, Dow Jones and NASDAQ were up by 0.55% (14.6 points), 0.36% (86.55 points) and 0.71% (50.1 points) respectively. The dismal performance of the US major indices was down to the poor macro figures namely the widening fiscal deficit in February to $ 57.6 bn (expected to be above a trillion dollars in 2020) and the slower than expected job growth of 2.3%, with only 103,000 jobs created in the month. The NASDAQ fared better than the broad market index as the technology sector experienced an uptick in the sales and profits. The European markets continued to face geopolitical risks arising from a weaker government in Germany and the resulting absence of leadership in the EU affairs with the uncertainty over the imposition of US import tariffs. The ECB’s decision to hold the interest rates steady and the positive sentiment as depicted by the demand should support increased economic activity in the upcoming months. The Euro Stoxx 50 gained 5.60% (187.5 points), while other major indexes namely CAC 40 and DAX gained 7% and 4% respectively. The markets in Asian Pacific far east were buoyed by the new bonhomie between the two Koreas with the Japanese Nikkei 225 gained 4.57% (1026.3 points) over the month and Hang Seng up by 2.94% (880.57 points). However, the Shanghai Composite remained under pressure from the Trade war concerns and lost -2.76% (87.55 points). Despite the weakness in Rupee against the US Dollar, the Indian market supported by a robust earnings report was indeed the best performer in April among the emerging markets with the BSE Sensex up 6.45% (2129.49 points).

WEEKLY EQUITY MARKET UPDATE – 06/05/2018