One of the reasons many people decide to live and work in the UAE is the zero per cent income tax. If that’s your case, the incentive might be an excellent opportunity for you to save more money. After all, you don’t have to pay out a large chunk of your salary each month in income tax.

Being able to save more money is great, because you want to ensure that money is there when you need it, not just for now but later in life. Whether it is for a comfortable retirement, your children’s education or a large asset purchase, you want to have money available.

Although this may be true, using a local or international bank to build up cash deposits won’t help your savings. The reason for this is simple. There is often zero or very little growth to this cash resulting in erosion due to real-time inflation. At the end of the day, your money is losing purchasing power while sitting in a bank savings account. Another key point to consider is the nature of a savings account. The money is always readily available to you. So you might end up using this cash to buy that extra pair of shoes, a night out or any other unnecessary purchase.

There’s a Better Way to Save

An anonymous source once said, “If you never save money or invest, you will always be poor, no matter how much you earn.” That’s a fact! We all know that if you always spend everything you earn you will never have money.

As mentioned before, saving money is great. You should keep it up but in a more structured way. A way that gives you the medium to long-term growth opportunity while maintaining an element of access in times of difficulty.

Did you know that if you save your money rather than investing it, you will probably have to put away a lot more for a lot longer to achieve the same result?

Let’s take a look at the case study of ‘John Saver’ and ‘Daniel investor’ as an example.

John Saver vs Daniel Investor: A Case Study

Both men are the same age, working for the same company and earning the same income. They both have no debt, and very little in terms of assets. However, they are at a point where they understand the importance of putting aside money for their future. They feel that they need to save $1 million by the age of 60 to be able to retire comfortably.

John Saver:

- Age: 40

- Annual Salary: $100,000 USD ($8,333 pm)

- Current Savings: $100,000 USD

- Savings Goal by 60 (Retirement): $1,000,000

- Required Monthly Contribution: $3,750

John is already 50% through his working life but has only managed to save one tenth of the amount he needs to retire. To get to the desired $1 million, he needs to put away $3,750 per month into his bank account for 20 years.

The problem is that John has always been a bit of a spender. It might be very ambitious and quite challenging to change that suddenly and put away almost 50% of his salary towards savings.

As a result, John often fails to either set aside the total amount or dips into his savings as unexpected costs arise.

Daniel Investor:

- Age :40

- Annual Salary : $100,000 USD ($8,333 pm)

- Current Investment: $100,000 USD

- Investment Goal by 60 (Retirement): $1,000,000

- Required Monthly Contribution: $2,000

Daniel is also in a similar position. He is already 50% through his working life and has only managed to save one tenth of the amount he needs to retire. However, Daniel decided to set up a savings account aimed at investing regularly. To achieve his retirement goal of $1 million, he will have to contribute $2,000 per month.

This money is directly debited from his account the day after his salary is deposited as a disciplined action. Therefore, he doesn’t even have a chance to notice the money gone.

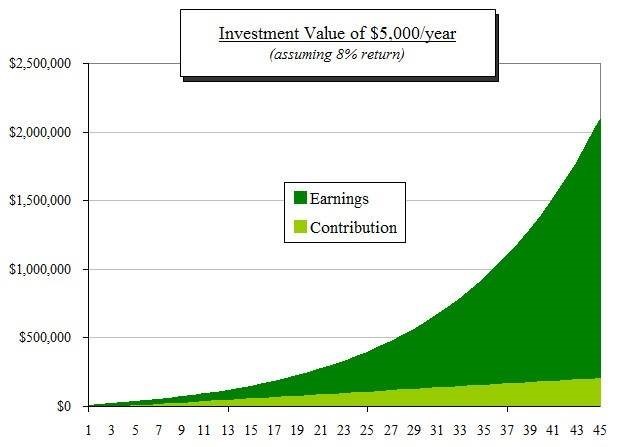

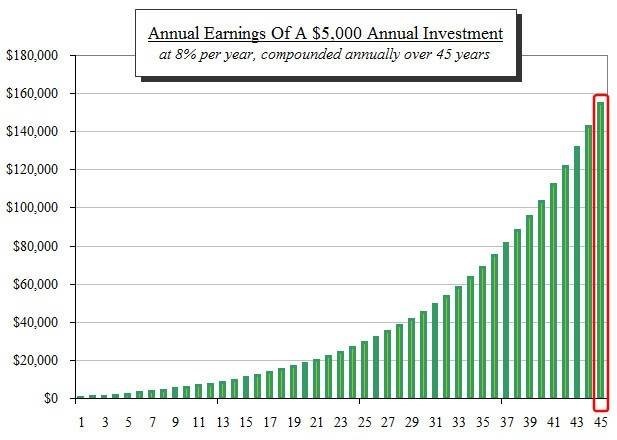

Daniel’s funds are then actively invested and managed. They are now benefiting from the wonderful wonders of compounding interest. This means he is taking full advantage of accumulating interest on top of accumulated interest for all the years he is investing.

Let’s put compounding interest into perspective. Daniel’s initial deposit of $2,000 will be worth $5,300 at the end of the 20-year term! At the same token, his first year’s contribution of $24,000 will be worth $63,700 by the end of the term*.

As a result, Daniel can continue leading the life he enjoys. He can keep the small luxuries and current lifestyle, knowing he is well on the way to achieve his retirement goals.

In fact with the additional spending money that he is left with every year, Daniel is planning on taking a three week holiday travelling around Europe later this year and will be on track with putting a down payment on an investment property this time next year.

If Daniel decided to contribute the same amount to his investment plan as his friend John, he would have a whopping additional $787,000 in his pension pot by the time he was ready to retire.

So ask yourself… Do you want to work smarter, or harder? Are you John or Daniel?

* This projection is based on illustration purposes. If you decide to set up any structured savings, the term should be determined by affordability and time scales in the UAE. A short-term plan may suit you better.

You no doubt have heard about The benefits of diversification, It’s not just “all talk”. Your portfolio must have some degree of diversification. After all, you don’t want to “put all your eggs in one basket”.

You no doubt have heard about The benefits of diversification, It’s not just “all talk”. Your portfolio must have some degree of diversification. After all, you don’t want to “put all your eggs in one basket”.

We would like to share with you this excellent article on the power of the compound interest, published by

We would like to share with you this excellent article on the power of the compound interest, published by

Your will is the best decision you can make to protect your loved ones. To ensure you look after your family especially after you have gone. The reality is that so many people neglect their affairs after their passing, only to add to the distress of those they leave behind.

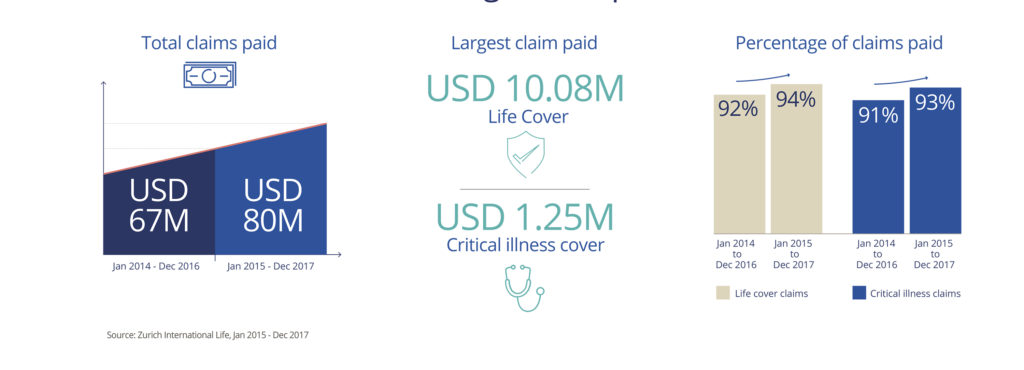

Your will is the best decision you can make to protect your loved ones. To ensure you look after your family especially after you have gone. The reality is that so many people neglect their affairs after their passing, only to add to the distress of those they leave behind. We would like to introduce you to our client Jennifer Gonzalez-Diaz, Sales Manager, Digital Content at DU Telecommunication. In this interview, Jennifer shares her experiences about her critical illness journey, the impact on her life and the importance of protection.

We would like to introduce you to our client Jennifer Gonzalez-Diaz, Sales Manager, Digital Content at DU Telecommunication. In this interview, Jennifer shares her experiences about her critical illness journey, the impact on her life and the importance of protection.