Following on from us covering the difference between Saving vs Investing and with so much reported on the recent market movements, it would be important to highlight why and what the impact is of investing at the right time. Also what the true effect is of continuing to use purchasing power over time to ultimately add value to your portfolio.

While much information circulates in our community regarding the impetus to buy good value stock, equity or units in funds, there is one classical item which could use attention with respect to the value of buying during corrective periods. That item is the power of Dollar Cost Averaging over time.

When you create and review a set of dollar cost averaging numbers, it becomes apparent that during these periods of severe price decline or correction, accompanied mental exhaustion, great wealth is made.

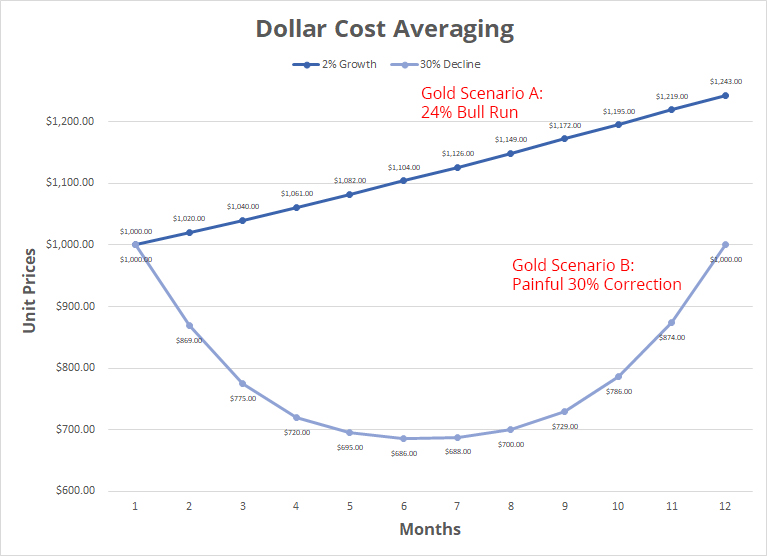

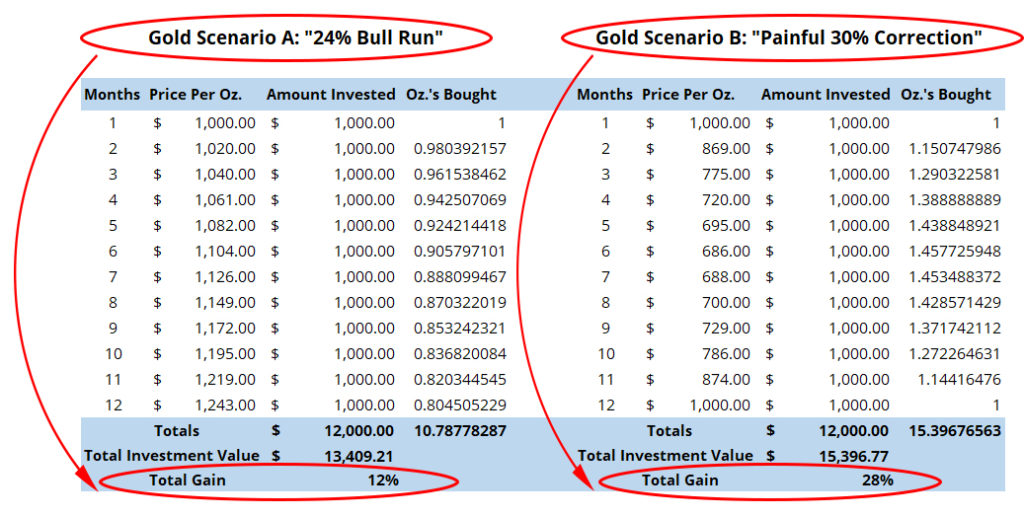

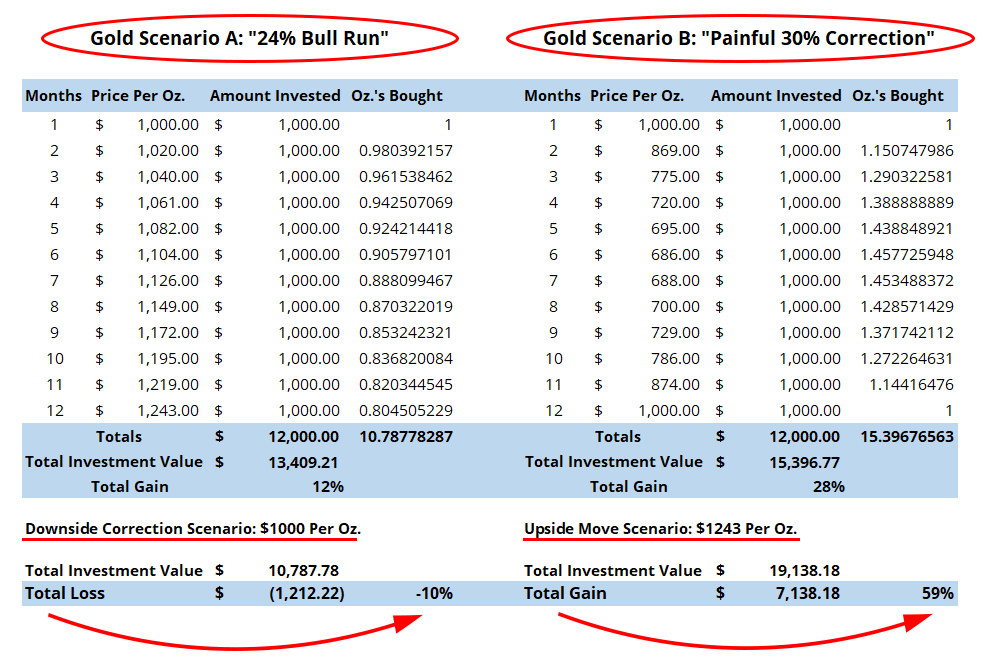

Illustrated below are two hypothetical price performance periods using gold as an example:

Gold Scenario A: depicts a 12-month period of increasing gold prices compounded at a 2% rate, producing a total of a 24% “bull run”. Gold Scenario B: depicts an extremely painful 30%+ correction and subsequent recovery to starting-point levels over a 12-month period.

At first glance, you might assume an investor gained 24% under Scenario A and nothing under Scenario B except for potential losses and grey hair. A closer look at a set of dollar cost averaging data however, tells a wildly different story.

Let’s assume an investor has the courage to create and execute a $1,000 a month investment program towards buying units. In applying that program to the two scenarios laid out above, a fascinating result begins to emerge:

As the numbers demonstrate, Scenario A’s 24% “bull run” produced a pitiful return on capital, and as a headline figure was very misleading. A disciplined investor allocating $1,000 a month under this scenario, saw a total real gain of only 12% at the end of the twelve month period.

Under Scenario B however, our disciplined investor’s $1,000 a month investment program produced a total real gain of 28% on his or her capital, in what could be described as a “sideways” (or unprofitable) unit price environment.

What’s also interesting to note, is that not only did Scenario B produce a far greater gain, but it does so at a (counter-intuitively) much lower risk.

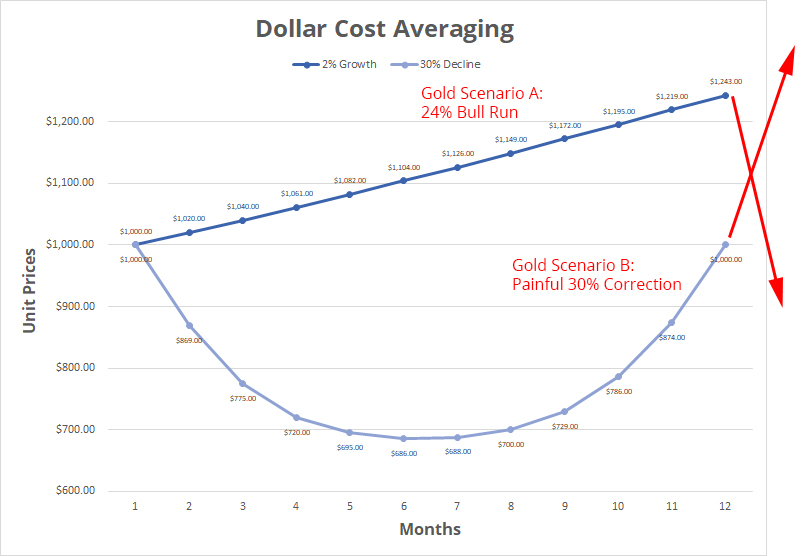

To illustrate, let’s assume that at the end of the 12-month period Scenario A suffers a “minor dip” in price, returning to its initial starting level at $1,000 per unit. Let’s also assume Scenario B jumps by 24%, effectively switching places price-wise with Scenario A. Here is a chart of that price swap:

As mentioned, while this price swap appears to be just a “minor dip and corresponding jump”, as the numbers will indicate, the risk of financial loss in Scenario A becomes staggering, while the upside gains under Scenario B become equally explosive:

As demonstrated, a correction to starting point in Scenario A produces a real total loss of 10%. A price swap in Scenario B on the other hand (i.e. a move from $1,000 per unit to $1,243 per unit), produces a 59% total gain. Therefore, the disciplined investor who continued to allocate $1,000 a month in the face of a frightening 30% collapse, was rewarded tremendously.

The moral of the story here is to continue to add fresh capital to your investments during declines. And it doesn’t have to be in just one Fund you can utilise those Funds surrounding Commodities, Healthcare, Technology or Shares of Companies.

Additionally, when struggling through the corrective depths of any asset’s “Scenario B”, it’s important to ensure that whatever you’re accumulating has real (and strengthening) fundamental value. Therefore, the longer the corrective period persists the greater will be your ultimate upside in the subsequent recovery. In other words, with strengthening fundamentals time is labouring for you rather than against you.

Bottom Line: The discipline of incremental investment over time may position one for explosive upside gains and reduced downside risk. Ensure that whatever is being accumulated however, is fairly priced, and of increasing fundamental value.