March 2018

Monthly Market Summary

March 2018

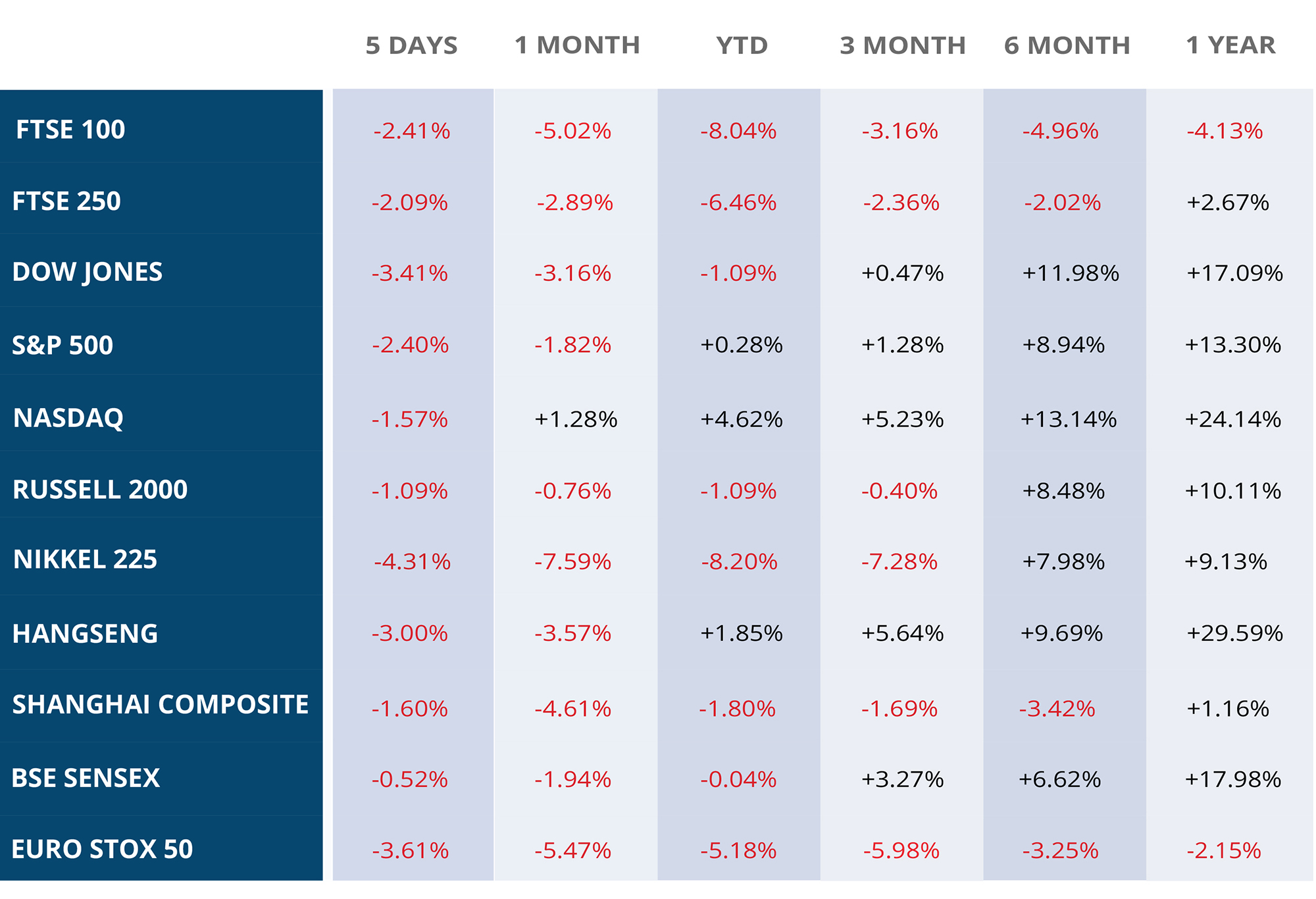

Fears of Trade War drive stocks down as the key US share indexes came under pressure in early hours of trading on Friday as President Trump in his tweets indicated of his plan to impose tariffs on steel and aluminium. The news pulled down the global markets amid the possibilities of retaliation from China and major economies and the consequent slowdown in global trade. The Dow finished up 0.3% as most of the losses were recovered in the later hours of trading. Regardless of the late recovery, the indexes witnessed one of the worst weeks this year. The DJIA, S&P 500 and NASDAQ posted their weekly figures of -3%, -2% and -1.1% respectively. The threat of an international trade war also sparked concerns in the fixed income markets as the companies may look to pass on the rise in cost from tariffs to the consumers. It is causing an increase in the expected inflation, leading to a rise in the yield of the 10 – year Treasury Note to 2.855% on Friday from 2.802% on Thursday. The Japanese equity was worst affected by the trade concerns as the steel industry and automakers bearing the brunt of the trade restrictions. The Nikkei ended the week at 21,181.64, a loss of 3.25 percent against the week earlier. The large-cap TOPIX Index fell 2.96 percent for the week and declined 6.01 percent YTD. The FTSE 100 index ended at 7,069.90, the lowest close since Dec. 23, 2016, according to FactSet data. No sector gained ground, and the basic materials group fell the most. For the week, the London benchmark fell 2.4%, a second straight weekly decline. The political risk in conjunction with the weaker economic prospects arising from inflation and a lack of real wage growth and the issues related to BREXIT has resulted in mounting pessimism towards UK equities. Emerging markets are likely to pay a heavy price as the proposed trade restriction will result in higher commodity prices in the international markets and the consequent fall in the local currencies. Emerging markets have witnessed an outflow of $5.8 billion of funds from non-resident investors last month, a report from the Institute of International Finance shows.

WEEKLY EQUITY MARKET UPDATE – 04/03/2018

Leave a Reply

Want to join the discussion?Feel free to contribute!