January 2018

Monthly Market Summary

January 2018

Wall Street buoyed by earnings optimism and retail sales data

Wall Street continued its upward trend on Friday, driven by the stellar increase in corporate earnings and robust retail sales drove investor optimism about economic growth. The S&P 500 and Nasdaq both registered their eight record closing highs out of the first nine trading days of 2018, while the Dow boasted its sixth closing high of the year. Earnings for S&P 500 companies are expected to increase on an average by 12.1 per cent in the quarter, with profit for financial services companies likely to increase 13.2 per cent. The Dow Jones Industrial Average rose 228.46 points, or 0.89 per cent, to 25,803.19, the S&P 500 gained 18.68 points, or 0.67 per cent, to 2,786.24 and the Nasdaq Composite added 49.29 points, or 0.68 per cent, to 7,261.06. Bank stocks were helped by a rise in Treasury yields after underlying U.S. consumer prices for December posted the biggest gain in 11 months, signalling a pickup in inflation. The S&P consumer discretionary index jumped 1.3 per cent after retail sales data showed households bought more goods, suggesting the economy exited 2017 with strong momentum.

Concerns over NAFTA and China intensifies Forex volatility

The fears of US pulling out of NAFTA prompted a massive sell-off in Mexican peso and Canadian dollars this week. The US dollar over the week remained under pressure over reports that China may reduce their US treasury holdings or halt any further purchases. Many believe that China may do this in response to the US levying tariffs on Steel and Aluminium imports or introduce any other form of trade barriers to pursue Donald Trump’s protectionist agenda.

Rate hikes more likely as data portends rising inflation

The likelihood of Fed rate hikes further strengthened as the US inflation rose to 1.8% from a year earlier, and is expected to see further increase backed by robust growth and low unemployment levels. The core US consumer prices rose by 0.3% in December, beating the estimate of 0.2%. The yield on the policy sensitive 2-yr Treasury rose above 2% for the first time since the financial crisis, and the benchmark 10-yr yield rose 5.6 basis points to 2.58%.

China’s trade surplus with the US reaches the all-time high

China has reported its highest-ever annual trade surplus with the US last year, an increase of 10% y-o-y according to Chinese customs data released Friday. The rise in demand resulting from the recovery in the US economy gave a fillip to the Chinese exporters, pushing up the Chinese shipments. This event further strengthens the likelihood of a trade war between the world’s two biggest economies. China’s overall trade surplus over the year contracted by 17% as the imports from countries like Russia, Saudi Arabia and Australia got costlier due to the rise in prices of oil and other commodities.

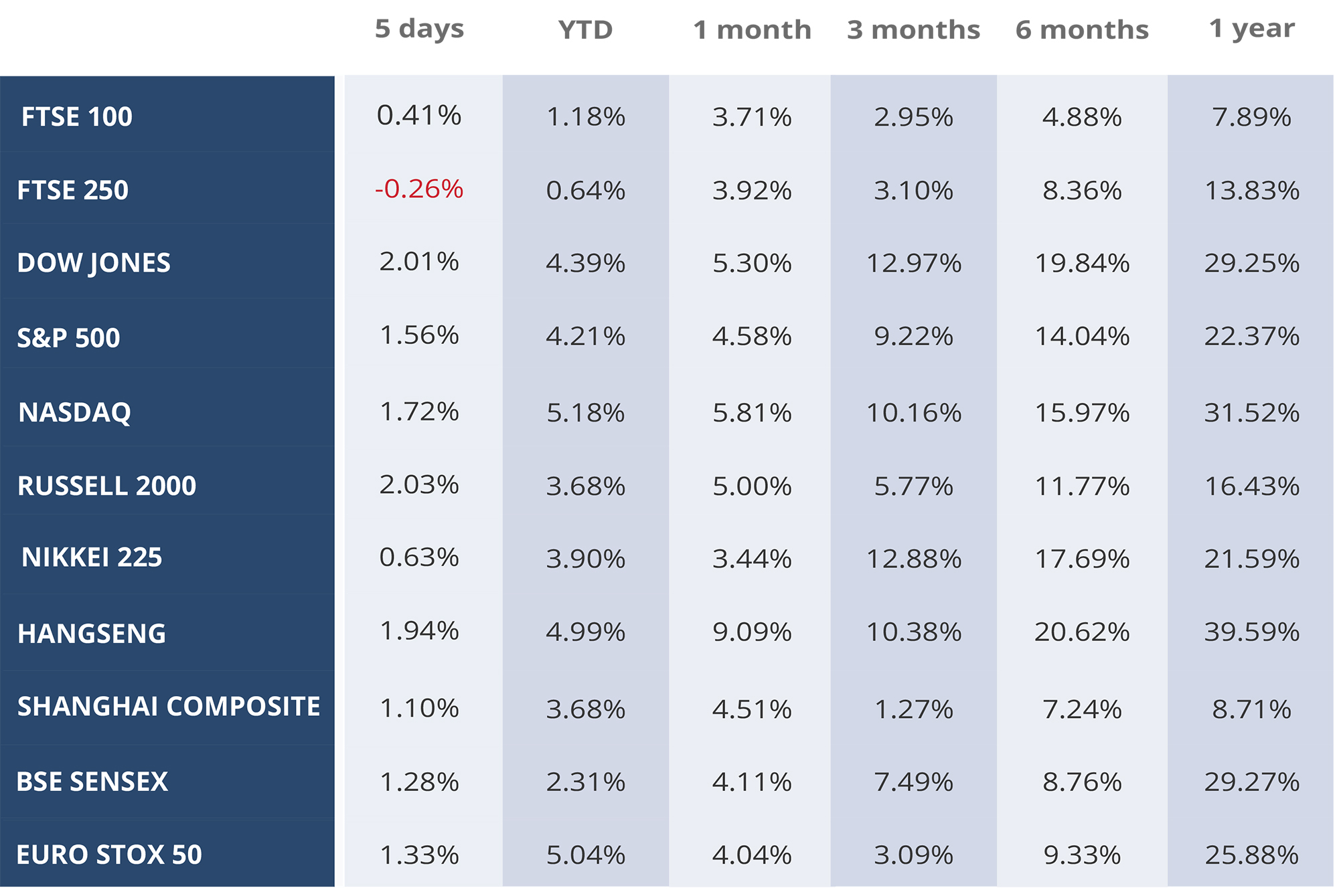

WEEKLY EQUITY MARKET UPDATE – 14/01/2018

Leave a Reply

Want to join the discussion?Feel free to contribute!