Monthly Market Summary

May 2018

WEEKLY EQUITY MARKET UPDATE – 06/05/2018

The Sun had set, the temperature dropped, and the late evening was upon us. There was excitement in the air and with a backdrop of the Dubai Marina skyline the stage was set at Emirates Golf Club, but this was for something more than just a round of Golf.

On Thursday 19th April, we held the AOP Spring Client Cheese & Wine night, courtesy of Jones the Grocer at Emirates Golf Club.

Having held the event in December 2017 we chose a new venue & partner, offering a varied experience of bites, grapes and live music to set the mood and give something back to our loyal clients.

With an unlimited cheese board consisting of Manchego, Brie De Meaux, Blue De Caisses, Buche Jacquin Herbes and Keen’s Cheddar. Flavours that were soft, strong and bitey and a fine selection of Fondue with Breads, Grisini and Antipasti there was enough to satisfy even the biggest of appetites.

This was all washed down by a wine selection that didn’t disappoint with Whites giving subtle taste and zesty flavours from Chardonnay to Sauvignon and Semillon. Bold Reds from Merlot, Shiraz and Cabernet hitting the spot with big fruity undertones. Also, a Zinfandell that was like a glass full of strawberries, whatever your taste there was something for everyone.

The ambience was ever flowing with a live band giving us a twist on modern Jazz and funky covers. There were even a few movers and shakers at the dancefloor! The setting was great and the people were wonderful. A fantastic evening enjoyed by all, with a request for the next one to be sooner rather than later.

“A bottle of wine contains more philosophy than all books in the world” – Louis Pasteur

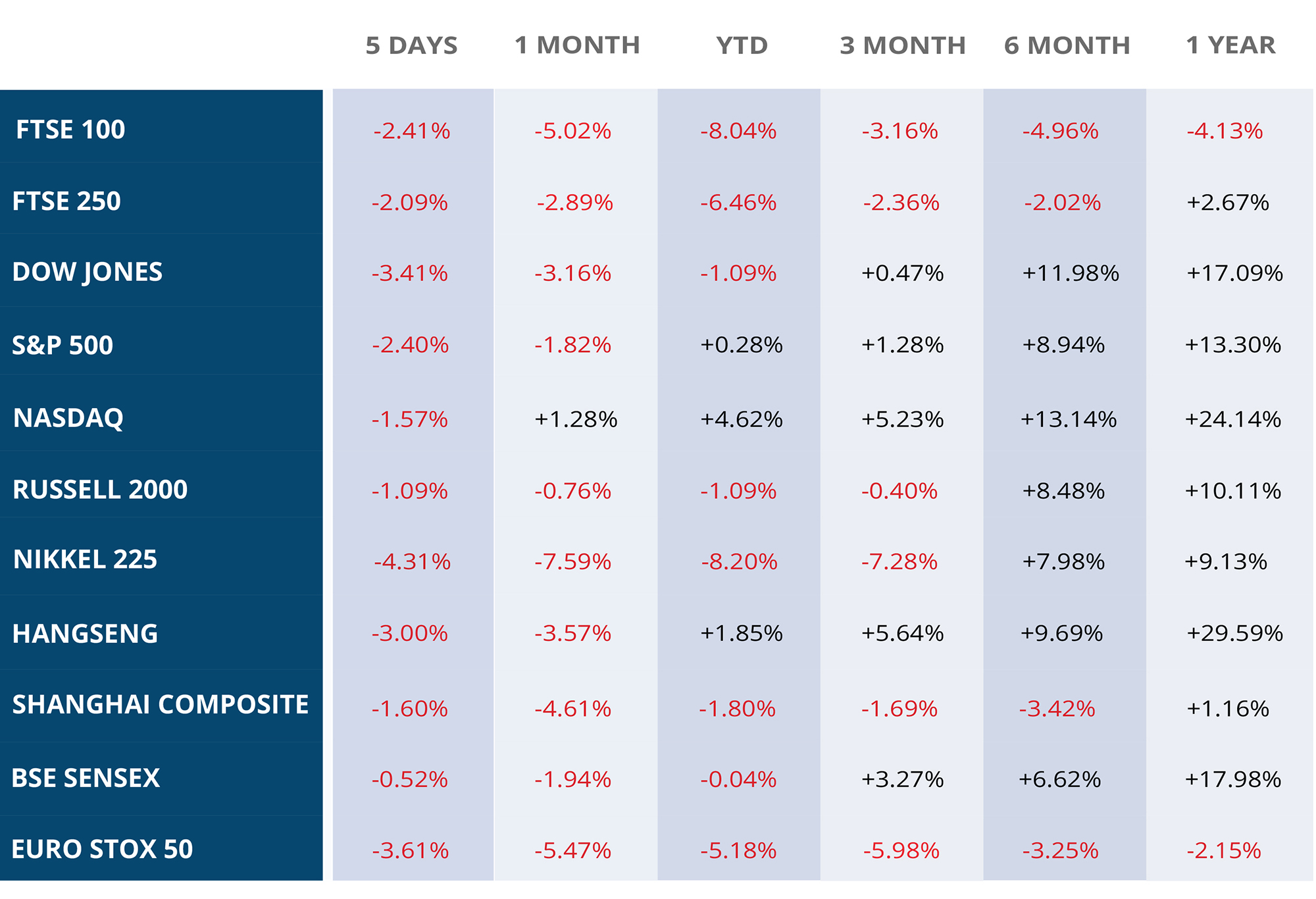

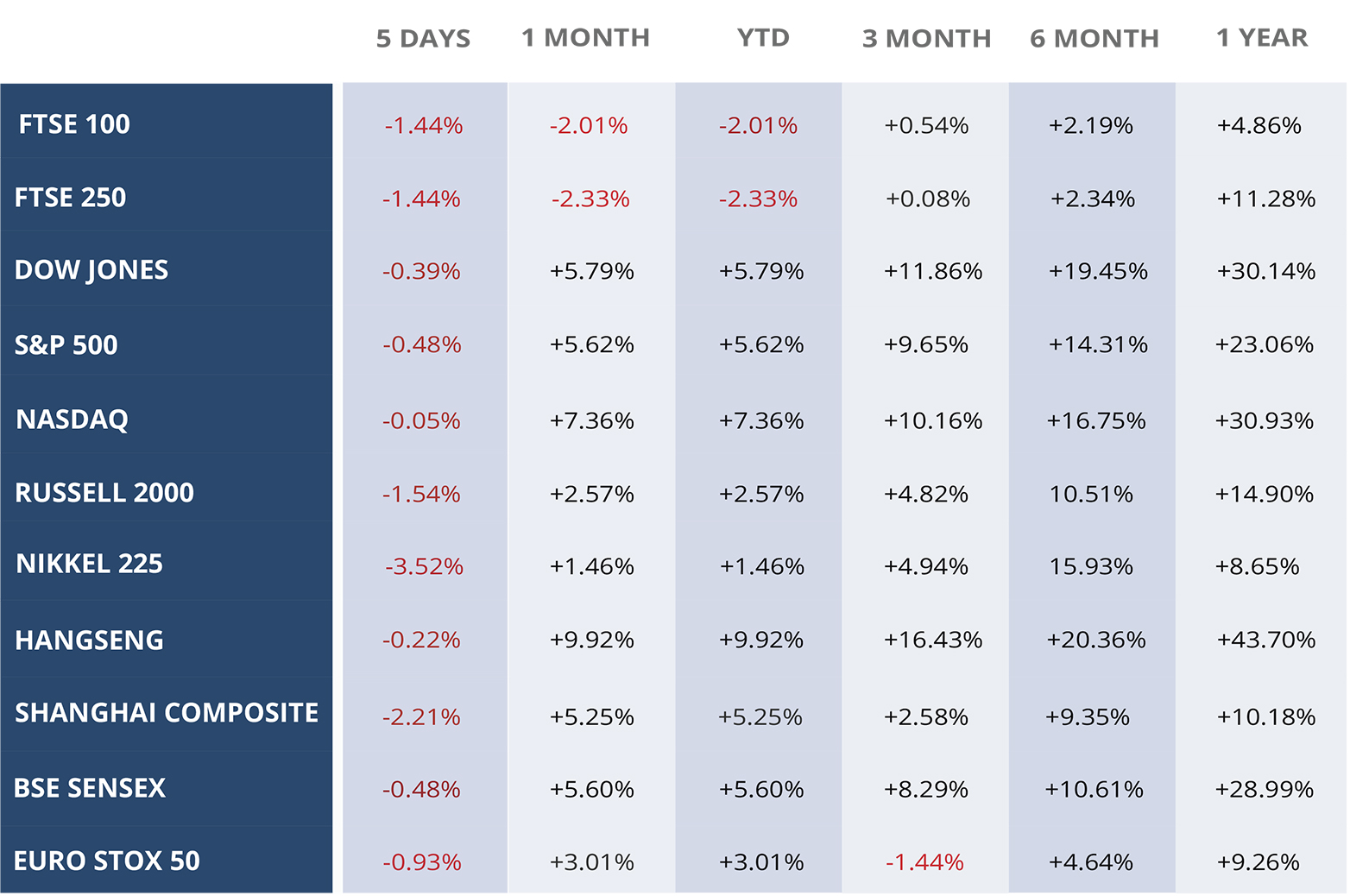

The volatility in March was mostly driven by the concerns of a Trade War between the two biggest economies in the world, namely the US and China. The month started with the hawkish tweets from Donald Trump signalling possible tariffs on imports, although the rhetoric toned down with the Europe managing to get an exemption from tariffs. The markets feared that any retaliatory measure from the Chinese side will dampen the trade and the hard-won growth momentum in the economy. The threat of the trade war became real when the Trump administration announced the tariffs on steel imports from China.

The market sentiment was further dampened by Fed’s interest rate hike, which was the first of its four-planned rate hikes this year and the sixth since it began raising interest rates in December 2015. The Technology sector took a major dip due to the risk of increased regulations after Facebook was found to have been involved in a user-data controversy linked to Donald Trump’s presidential campaign in 2016.

Summing it all up, markets in the month of March followed the high volatility trend it inherited from February 2018, depicting the phenomenon of “Volatility Clustering” which essentially means a period of high volatility is followed by another period of high volatility till a reversal or an inflection point is reached.

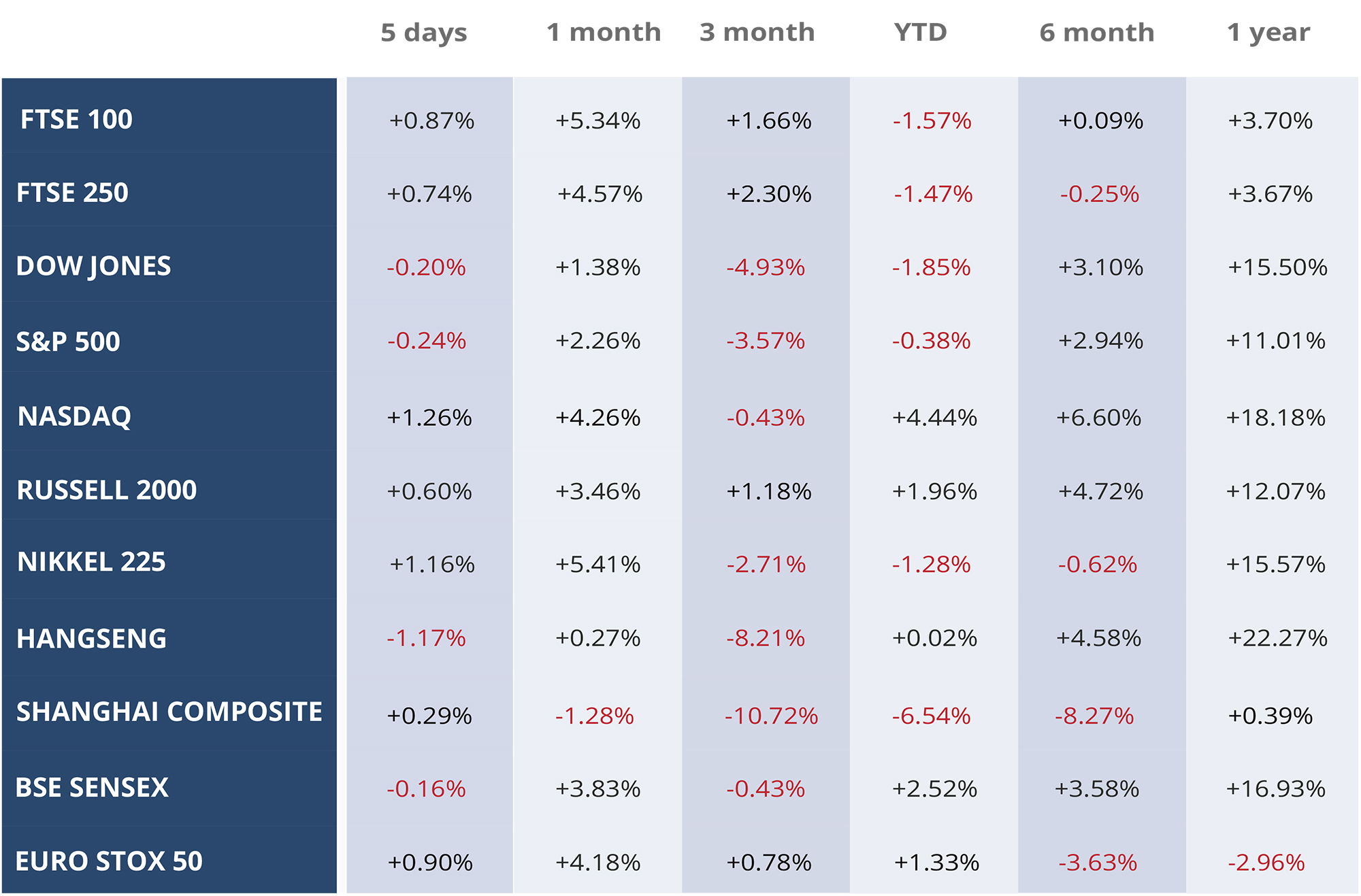

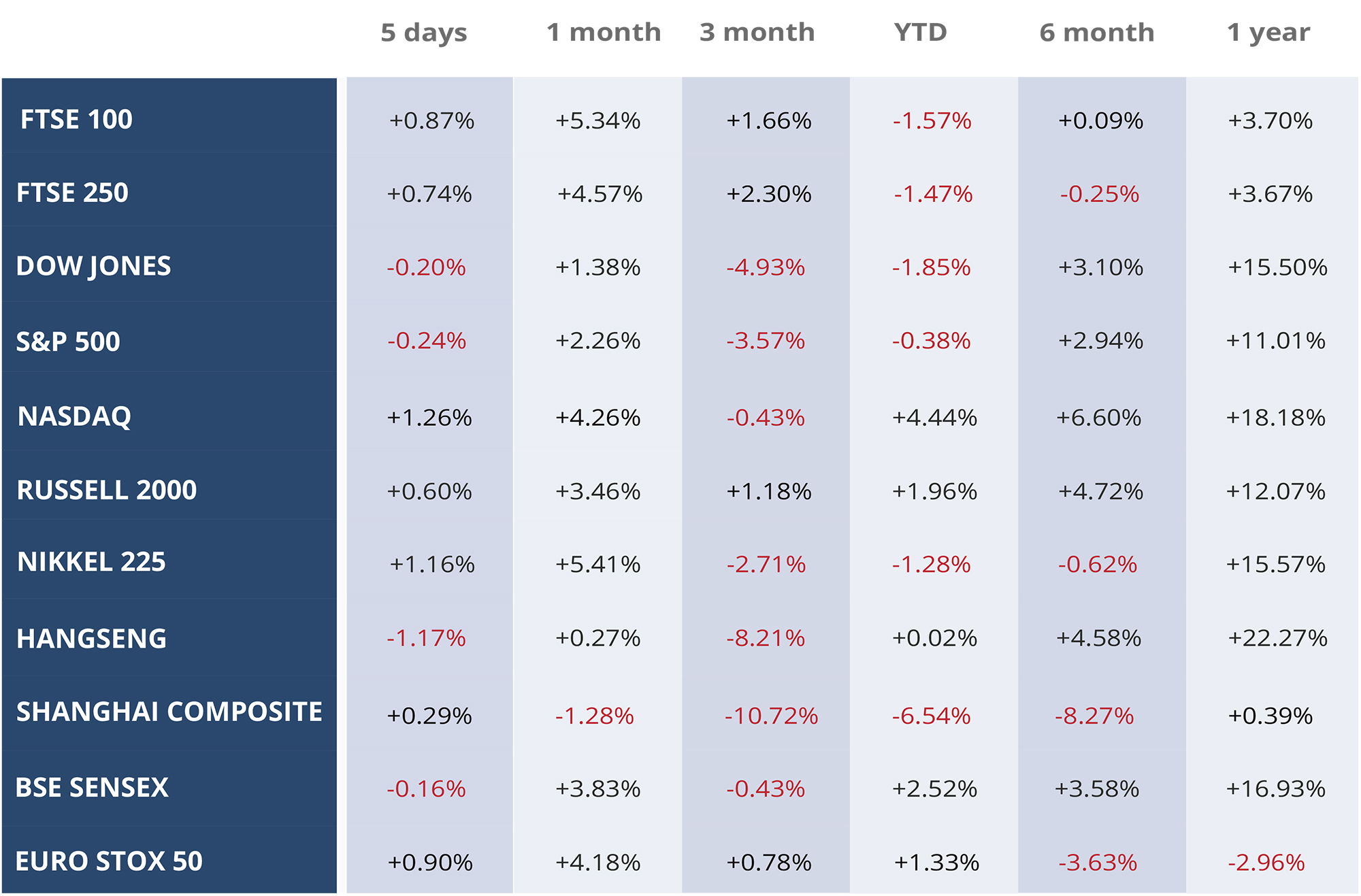

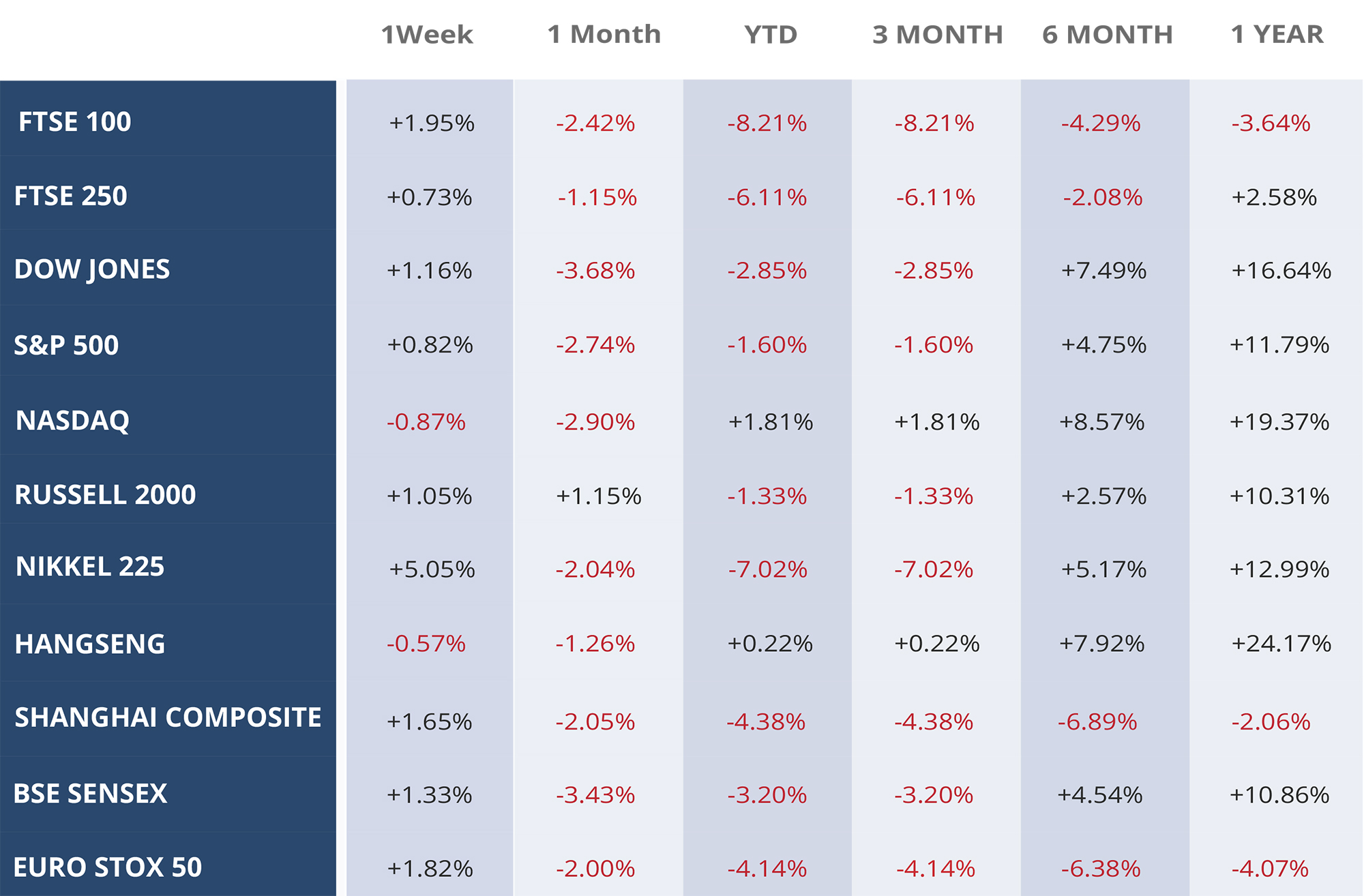

The major US markets ended the month in red with the Dow Jones Industrial Average losing 3.68 per cent, while the Standard & Poor’s 500 Index sliding 2.74 per cent and the NASDAQ Composite falling 2.90.

In addition to the global trade concerns, the BREXIT woes continue to haunt the UK markets. The FTSE 100 & FTSE 250 ended the month in negative 2.42% and negative 1.15% respectively.

Despite stronger earnings data in Europe, the markets succumbed to the pressure of increased tariffs and the resulting trade war. The STOXX 50 lost nearly 2% over the month.

The Nikkei 225 lost 2.04% this month, the Japanese bourse came under pressure from a stronger yen and global trade fears. It is also a major concern among investors that Japan can be the next target of US trade tariffs. The major emerging markets moved in concert with the developed markets, with the HangSeng losing 1.26%, the Shanghai Composite down by 2.05% and BSE Sensex fell by 3.43% in March.

Despite the increase in rates by the Fed, the Treasury yields fell in March due to the revised labour report, weaker than expected inflation data and the increased buying activity in the bond markets prompted by the volatility in equity markets as the investors looked for safer assets in the market. The 10-yr Treasury Yield ended the month at 2.741%, down 0.131 percentage points.

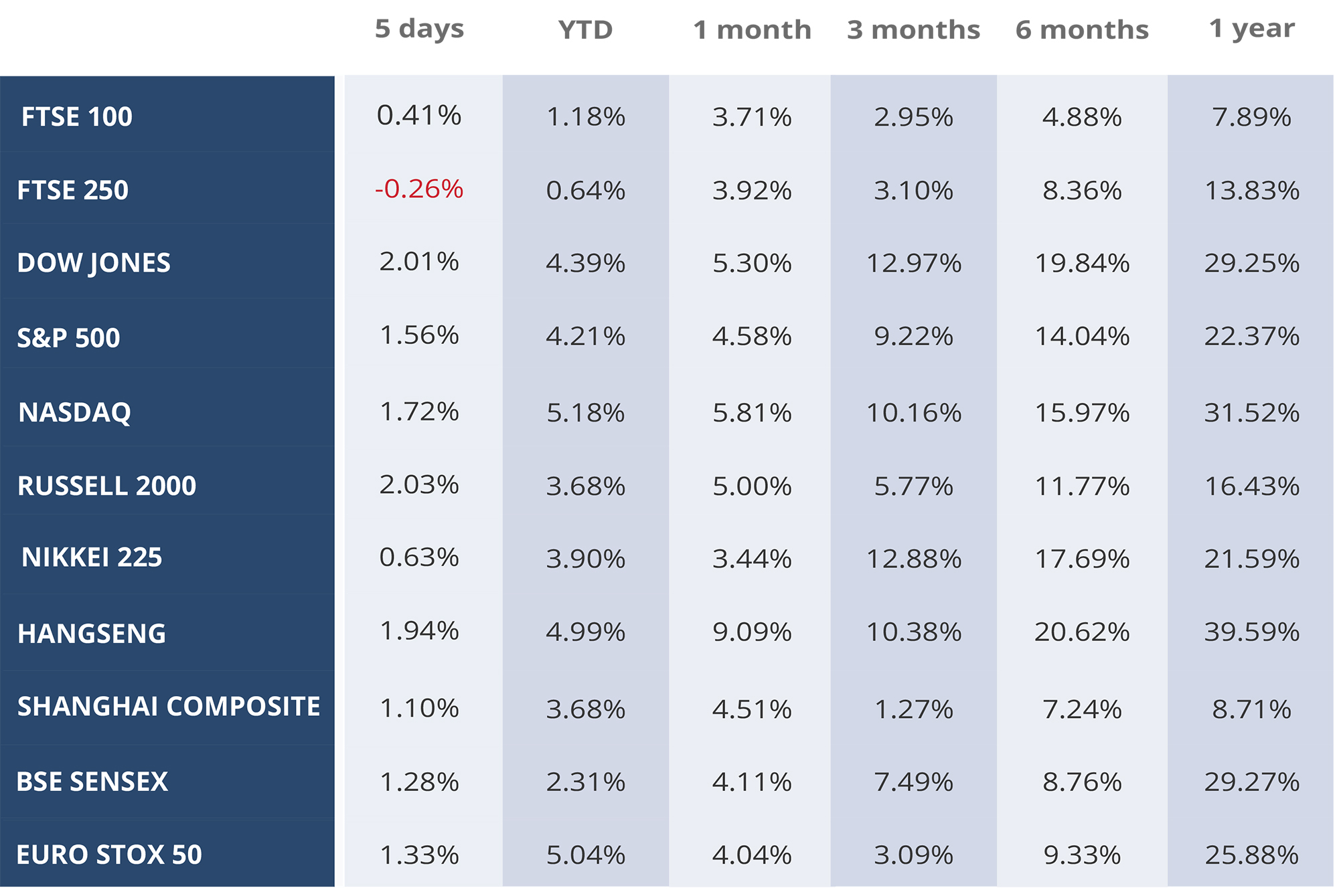

US Equities continued their upward momentum in January supported by a strong earnings data and the robust growth in retail sales in the US. The S&P grew by 5.6% in January; the strong earnings dampened the impact of lower than expected GDP growth rate for the last quarter of the year.

In the US Fixed Income domain, the recovery in the US and job growth has further strengthened the case of rising inflation, thereby increasing the bond yields and lowering the bond prices, the US 10 yr Treasury yield now sitting at 2.7%. Although the US core inflation stood at 1.8% (below the target of 2%), the Fed is confident of it reaching this target and therefore is determined to follow a tight monetary policy to prevent overheating in the economy.

UK equities remained under pressure as the investor confidence deteriorated over the concerns of BREXIT uncertainty restricting the UK in benefiting from the recent spur in Global economic growth. The gains in Sterling further added to the pressure on FTSE 100, as 70% of its companies generate revenues outside the UK. Investors remain optimistic about European equities with the consumer confidence and PMI at record high levels as per the surveys, the Eurozone seems to be into a robust recovery period. The pan – European benchmark STOXX 600 ended the month up 2.1%.

The Nikkei 225 posted a paltry +0.1% over the last month. The market had some initial upswings in the month. However, the monthly performance was dampened due to the pressure from a rising Yen against the Dollar at the end of January, and the concomitant Wall Street sell-off in the futures market.

China’s manufacturing sector PMI came out to be lower than expected in January amid a cooling property market and tighter pollution rules that have curtailed factory output. The Indian stock markets posted their best one-month pre-budget gain in 13 years, the performance was a result of growing optimism and the investor confidence in the government reviving investment and growth in the last full budget before next year’s general election.

US Dollar exchange rate had one of its significant declines in January, down 3.2% against the basket of major currencies. The widening current account deficit with the strengthening global growth outside the US had put downward pressure on the dollar. Comments from the US Treasury Secretary Steven Mnuchin highlighting the advantages of a cheap dollar exchange rate further added to the dollars misery.

Oil had an excellent start to the year with the Brent gaining 3.26% over January 2018. The move was a result of OPEC’s decision to cut output. The fall of the USD exchange rate also supported the higher prices.

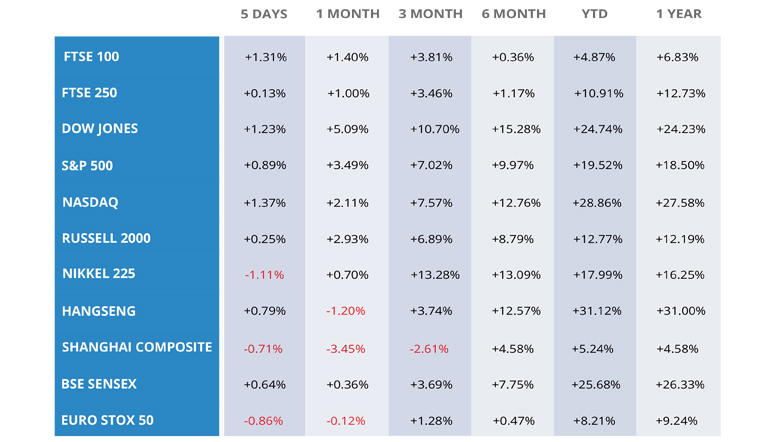

Wall Street continued its upward trend on Friday, driven by the stellar increase in corporate earnings and robust retail sales drove investor optimism about economic growth. The S&P 500 and Nasdaq both registered their eight record closing highs out of the first nine trading days of 2018, while the Dow boasted its sixth closing high of the year. Earnings for S&P 500 companies are expected to increase on an average by 12.1 per cent in the quarter, with profit for financial services companies likely to increase 13.2 per cent. The Dow Jones Industrial Average rose 228.46 points, or 0.89 per cent, to 25,803.19, the S&P 500 gained 18.68 points, or 0.67 per cent, to 2,786.24 and the Nasdaq Composite added 49.29 points, or 0.68 per cent, to 7,261.06. Bank stocks were helped by a rise in Treasury yields after underlying U.S. consumer prices for December posted the biggest gain in 11 months, signalling a pickup in inflation. The S&P consumer discretionary index jumped 1.3 per cent after retail sales data showed households bought more goods, suggesting the economy exited 2017 with strong momentum.

The fears of US pulling out of NAFTA prompted a massive sell-off in Mexican peso and Canadian dollars this week. The US dollar over the week remained under pressure over reports that China may reduce their US treasury holdings or halt any further purchases. Many believe that China may do this in response to the US levying tariffs on Steel and Aluminium imports or introduce any other form of trade barriers to pursue Donald Trump’s protectionist agenda.

The likelihood of Fed rate hikes further strengthened as the US inflation rose to 1.8% from a year earlier, and is expected to see further increase backed by robust growth and low unemployment levels. The core US consumer prices rose by 0.3% in December, beating the estimate of 0.2%. The yield on the policy sensitive 2-yr Treasury rose above 2% for the first time since the financial crisis, and the benchmark 10-yr yield rose 5.6 basis points to 2.58%.

China has reported its highest-ever annual trade surplus with the US last year, an increase of 10% y-o-y according to Chinese customs data released Friday. The rise in demand resulting from the recovery in the US economy gave a fillip to the Chinese exporters, pushing up the Chinese shipments. This event further strengthens the likelihood of a trade war between the world’s two biggest economies. China’s overall trade surplus over the year contracted by 17% as the imports from countries like Russia, Saudi Arabia and Australia got costlier due to the rise in prices of oil and other commodities.

The US equity indices and the dollar ended the week up as the investor sentiment strengthened over the likelihood of the passage of the tax overhaul before the end of this year. The Dow Jones rose by 143.08 or 0.6%, the S&P 500 was up by 23.80 points or 0.9% and the NASDAQ composite advanced by 80.06 points or 1.2%. The proposed tax cuts are likely to benefit the smaller companies and financial firms the most. The tax overhaul is to add to the already strong expectations about the economy and markets for the year 2018.

The pound lost 0.9% against the strong dollar over concerns of a tougher second round of BREXIT negotiations between the UK and the EU. The FTSE 100 posted a gain of 0.6% on Friday as the weakness in the sterling favoured the index which comprises mostly of companies with global operations. The EU leaders confirmed their satisfaction over the first phase of BREXIT talks, however the officials have called on the Prime Minister to clarify what Britain wants from its future relationship with the block.

US Govt bond prices fell on Friday but stayed up over the week, supported by the weak inflation data. The yield on the 10-year Treasury note settled at 2.353% compared to 2.383% last Friday. Over the week, the uncertainty around the passage of the Tax overhaul, the soft inflation figures and the demand for Treasurys from overseas buyers kept the pressure on the yields even after the Fed raised short-term interests.

Equity funds owning shares of companies in developed economies in Europe have witnessed outflows of $ 2.1 billion in seven days to Wednesday, according to the EPFR. Investors cashed in on the returns made this year after assessing the potential risks Europe faces in the coming year. The fall in the amount of debt the ECB will purchase every month, and the prospect of an Italian general election were some of the major potential risks to Europe.

The cost to derivatives that allows global investors access to US Dollars have gone up significantly. Such derivative contracts are used by non-US banks in their credit activities, any scarcity of dollars make it more expensive to borrow. New regulations introduced to make the financial system transparent and safer have made the dollar scarcer, the roll back of its monetary stimulus by Fed is likely to further add to this.

In his two-day visit to Beijing, Chancellor Phillip Hammond will sign a deal letting the Chinese banks to trade renminbi in the London forex markets. The Initiative is another step for the Chinese in internationalizing their currency, for the UK it means new business to London financial markets. The Chinese will be granted access to the “spot” foreign exchange in London with trades guaranteed by Shanghai Clearing House.

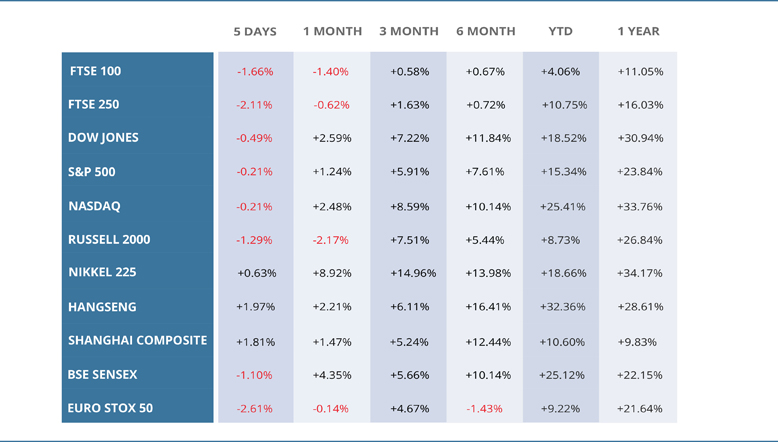

The week started with the ratcheting up of geopolitical tensions between Saudi Arabia and Iran, resulting in the sharp rise in oil prices. However, it was the US fiscal policy that garnered most of the attention in the markets after the Senate proposed their version of the draft tax bill, which differed noticeably from the House’s version. The expectations of the tax cut was one of the main reason for the rise in the dollar since the mid of September, as a result of the ambiguity in the tax bill the dollar index fell to 94.26 which is the lowest in two weeks before coming back to 94.42. The US equity benchmark was down by 0.4% this week ending the eight-week run of growth.

Skyrocketing demand has led to a record high issuance of Green bonds in the third quarter of the year. The issuance for the quarter ended in September stood at USD 32.7 billion which is a 1.55% increase over the USD 32.2 billion issued in the previous quarter. The issuance in the first three quarters of this year has been around USD 95 billion which is an increase of 49% year on year, based on the recent figures the full-year volume is set to surpass USD 120 billion for the first time in history.

The past week has seen an outflow of USD 4.5 billion out of US funds despite the improved performance of traditional investment managers, taking the cumulative outflow this year over USD 150 billion. Moreover, the performance of the active managers have increased considerably in 2017, about 55% of the fund managers have beaten their benchmarks this year making 2017 the best year for yearly performance since 2007. Japanese equity funds continue to receive significant inflows since Shinzo Abe’s victory last month. European bond funds had a positive week too, making this their second-strongest inflows this year.

The Senate in its draft tax bill proposed a tax of 10% on income from intangible assets such as intellectual property, however it would be levied differently on US companies and American subsidiaries of foreign companies. The income from US intangibles is likely to be taxed at a favourable tax rate of less than the new 20% proposed corporate tax rate, in order to encourage American companies to move intellectual property back to the US. The Senate also proposed for the US subsidiaries of foreign companies a minimum tax to prevent them from using intra-company payments for intangibles to reduce their effective tax rate below 10%.

China which has traditionally utilized joint ventures requirements and ownership limits in its industries to protect Chinese companies is likely to relax or remove ownership limits in Financial Services. The limit on foreign stakes in life insurance joint ventures will be increased to 51% in 3 years and removed entirely in 5 years. This move comes a day after Trump called on China to allow greater access to American companies.

The US economy seems it to be having its best period of growth in decades after the nonfarm payroll data released by the Labor Department showed unemployment at a 17-year low of 4.1%. The steady hiring resulted in lower unemployment and sustainable growth in the output. The Quarter 3 growth rate was approximately 3%. The markets greeted this news as another sign of a strengthening economy, with the DJIA and S&P 500 both finishing the week up by 0.4%.

After weeks of intense diplomacy and negotiations, a settlement has been reached between the UK and EU. The tentative agreement is to be endorsed by the EU at the Brussels summit next week. The divorce bill is likely to be in the range of GBP 36bn to GBP 39bn. The latest development marks a completion of the BREXIT phase one. The negotiations will now enter the critical second stage where more difficult decisions are to be made.

The US Govt bond prices fell, and the 10-yr Treasury yield rose to 2.383% after the low unemployment figures were released by the Labour Department. The expected rate hike by the FED this week is likely to be one in a series of future rate hikes to prevent the economy from overheating as prospects of inflation became stronger after the release of employment figures and the proposed Corporate Tax cuts.

The pound reversed the early gains it made on Friday after the news of the agreement between the UK and the EU over BREXIT. In the early trading hours on Friday, the pound reached above $ 1.35 against the US dollar however subsequently retreated to $ 1.3377, ending the day at -0.7%. The yield on policy-sensitive two-year gilt hit 0.567% before ending the session flat at 0.51%. the 10-year benchmark yield ended up 2 basis points higher at 1.28%

EU officials said that the US is threatening to damage global trade undermining WTO. the US is allegedly blocking appointments to a WTO appellate body that resolves trade disputes thereby sabotaging the system of global trade. US officials said that the WTO needs to adapt the changing dynamics of Global Trade and the challenges it faces. In his recent tirade against the WTO, President Trump accused it of being unfair to the US and at the same time alleged that China, the biggest exporter, has used WTO for its policy of mercantilism.

Investors poured $ 1.5bn into financial sector funds last week on optimism about the prospects of lighter regulation and less tax. This was the fourth consecutive week of inflows into the sector. The potential easing of regulations and corporate tax cuts increase the positive sentiment in the financial sector. Banks are likely to be the biggest beneficiaries of lower domestic tax rates.

Below the expected 310,00 figure economists had forecast, as the job market rebounded following Hurricane’s Irma and Harvey. The unemployment rate fell to 4.1 percent, the lowest level since 2000, due to the number of people in the labour force declining. Wage growth last month remained stagnant, growing at 2.4 percent year-on-year which is the slowest rate in 18 months.

Replacing Janet Yellen when her first term ends in February. Donald Trump made the appointment on Thursday after weeks of speculation that he could re-nominate Yellen or even make a more dramatic appointment. There was little disruption in the markets, with many economists noting that Powell will continue the same gradualist policy of hiking interest rates as Yellen.

With the bank rate rising 25 basis points to 0.5 percent. The Monetary Policy Committee voted 7-2 in favour of the hike although warned there remain risks to the UK’s economic outlook. Traditionally a rate hike would support a currency, however following the news the pound weakened against the euro and dollar to close the week at €1.1266 and $1.3077, respectively.

With the Nikkei 225 index up 2.4 percent from the previous Friday close. Positive market sentiment was driven by reassuring stability in the government following Prime Minister Shinzo Abe’s resounding victory in the country’s snap election. Abe immediately announced a $17bn injection of cash to deal with some of Japan’s greatest democratic challenges.

With Brent crude avoiding a retracement below $60 a barrel. Positive sentiment was helped by the falling number of active US oil rigs, although the strongest influence comes from this month’s OPEC meeting, with bullish investors hoping that the global curb on output will be extended until the end of 2018. WTI and Brent crude finished the week at $55.64 and $62.07 a barrel, respectively.