We are starting today our Back to School campaign which will run for five weeks. During this time we will be focusing on Family Protection, Critical Illness Cover, Education/University Funding and Wills/Guardianship Requirement in the UAE.

The campaign is designed to give you lots of information from us and our providers so you can make informed decisions regarding your family’s current and future planning needs.

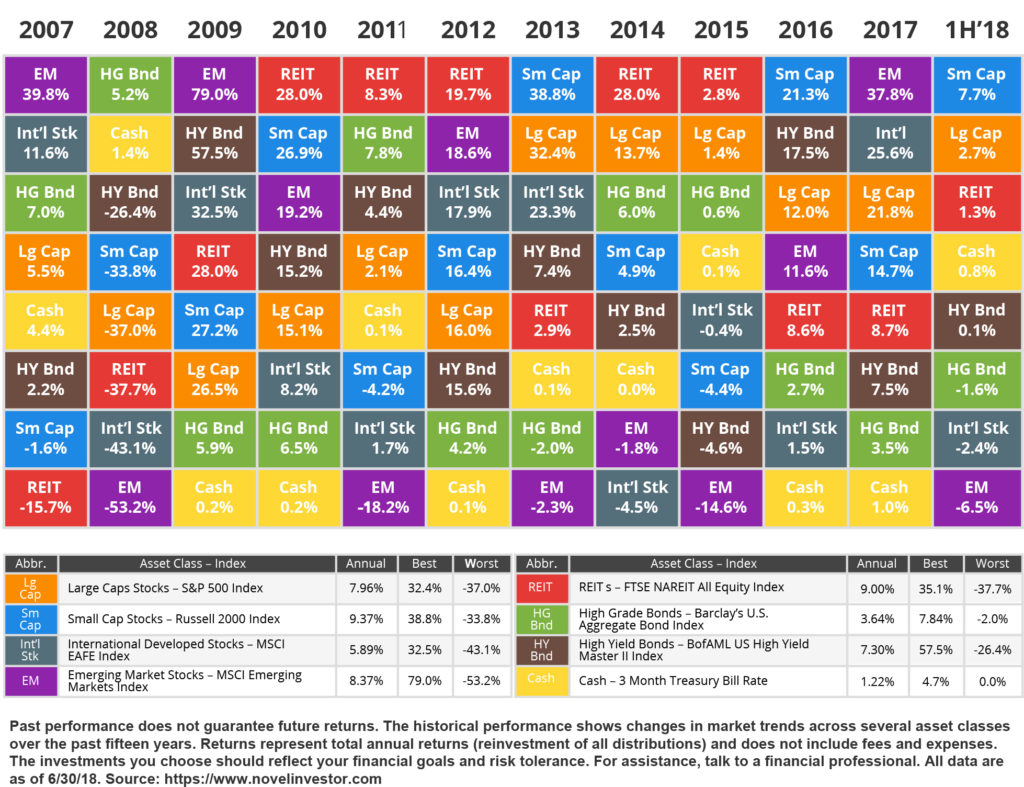

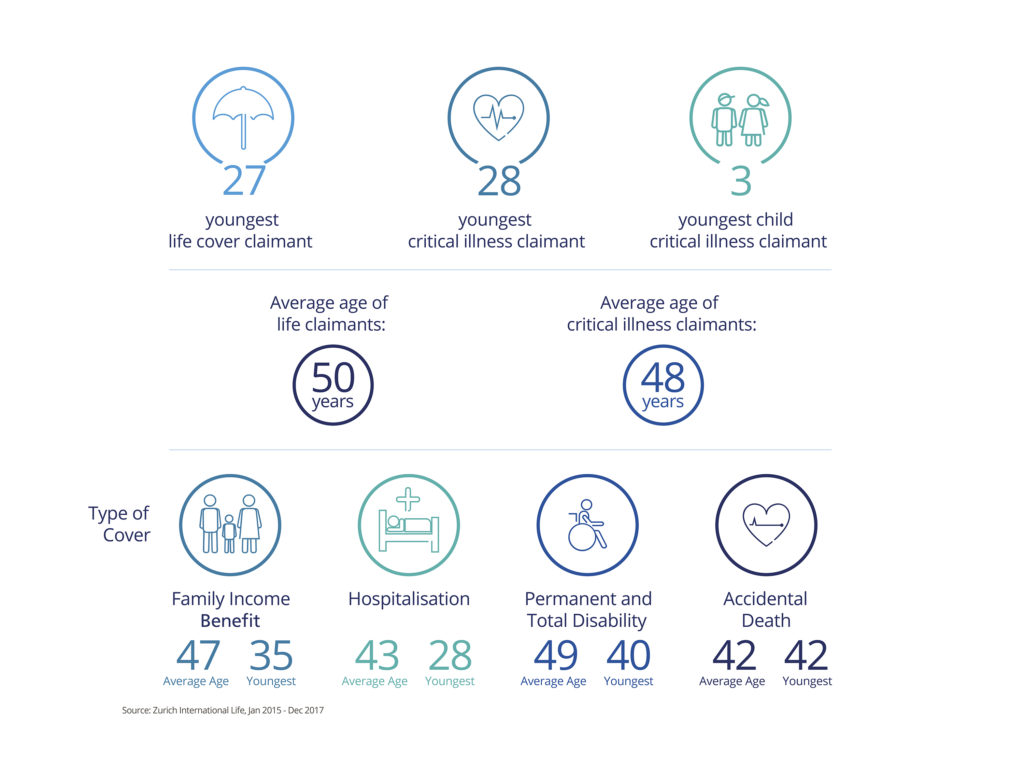

With this in mind, we would like to begin our campaign by sharing the Zurich Middle East Claims 2018 with you. It’s an annual report on claims statistics specific to this region published by Zurich International.

Health experts share their insights about risk

Insights from Zurich’s claims

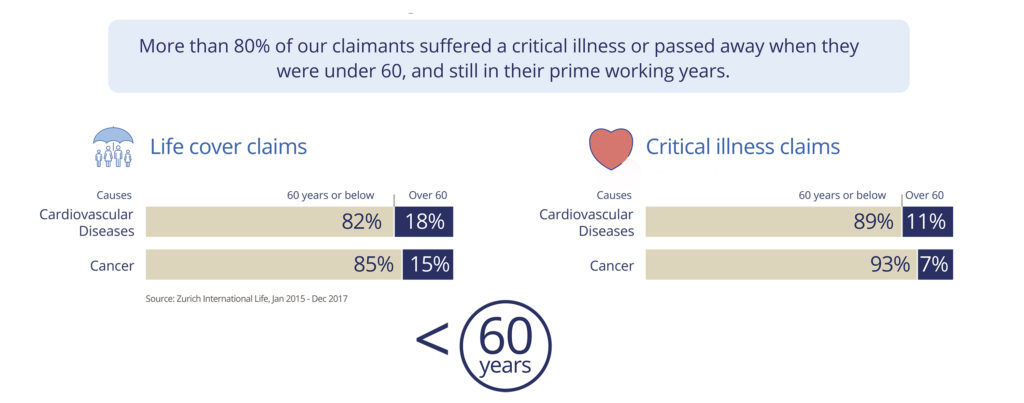

Key causes of claims

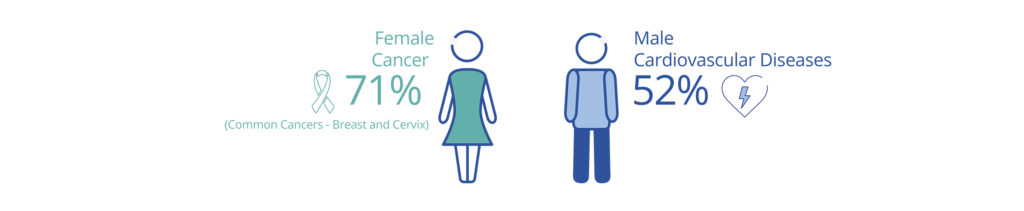

Age trends of claimants

The need for adequate protection

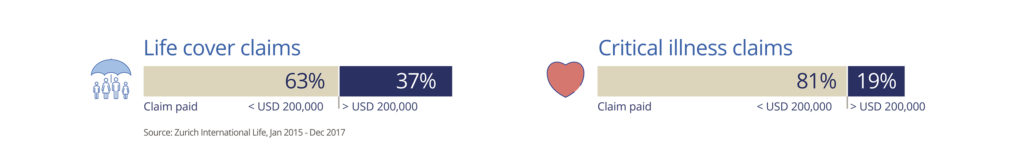

Is USD 200,000 enough cover? It might be. However, most of Zurich’s claimants were under the age of 60 with young families to support.

Click on the button below to calculate how much protection cover you need to protect your financial future.

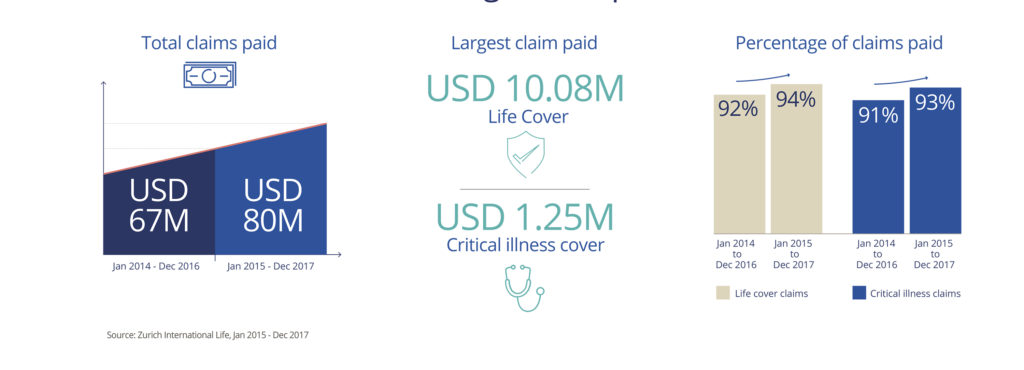

Claims delivered by Zurich

Zurich informs that the main reason they were not able to pay some claims was due to non-disclosure of a previous or existing condition. Therefore, providing information that is accurate and complete is crucial when applying for a protection policy. You should make sure to disclose your health history, family history, height and weight, and alcohol and smoking habits.